The strategy of retiring on dividends is, for many, an attractive proposition – live off the dividends without touching the capital – however, it suffers significant criticism from much of the financial community. Here are six reasons why for some retirees it might be a good strategy followed by six reasons why it might not be ideal for everyone.

6 Six Reasons Why Retiring on Dividends Might Work For You

1. You Want to Leave a Significant Inheritance and Don´t Need the Maximum Retirement Income

The concept of Retiring on Dividends is that you live on the dividend payouts and never sell your shares/investments so your capital is never touched. The capital is likely to increase over the years so leaving a sizeable inheritance for your heirs. However, by not selling down the capital you reduce your possible retirement income.

2. You´re Not Worried About Portfolio Falls of 40-50% Providing The Income Continues

If income is your priority and you can sleep well at night even through market turmoil, and you are not over-worried when your investments fall by 50% or so then Retiring on Dividends may be for you.

3. You Are Worried About Sequence of Return Risks

If you have a fixed retirement date with no option to continue to work or don´t have other possibilities for income you will probably be worried about a market crash occurring just prior to retirement or during the early years. This would mean selling shares when they are at their lowest and significantly diminish your portfolio. Retiring on Dividends allows you to receive an income during turbulent times without being forced so sell when the market is low.

4. You Want Simplicity and Don´t Want to Worry About Safe Withdrawal Rates, Portfolio Rebalancing and Equity/Bond Allocations

Pension Drawdown involves some difficult decisions.:-

- What is the safe withdrawal rate (SWR)?

- By how much can this be increased each year?

- What to do during market crashes?

- If the market performs well is it safe to increase my withdrawal rate?

- What bond allocation should I have to balance risk against return?

- From which asset class do I take my income and how should I rebalance?

Retiring on Dividends eliminates some tough decisions.

5. You Want Your Income Protected from the Sometimes Irrational Behavior of the Stock Market

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

― Benjamin Graham

Companies cannot control how the market prices its shares but they can control how much they pay in dividends. A company may have great earnings and capacity to increase dividends but if the market is going down so will its stock price.

Here is an example of how a company that pays dividends can provide the shareholder with some protection against market volatility:-

Company A (pays dividends) Company B (no dividends)

Share Price $100.00 $100.00

Earnings $5.00 $5.00

Dividend paid $5.00 $0

Ex div Share Price $100.00 $105.00

Shareholder benefit

$105 $105 share value

($100 share value +

$5 dividend)

The example shows that there is no difference for an investor who receives a dividend from a share or for an investor where the company retains its earnings and thereby boosts its net asset value.

However if the market then falls by 25% the winner is the investor in the company that pays dividends:-

Investor Company A Investor in Company B

Share price $100 -25% = $75 Share Price -25% =$78.75

Dividend $5

Dividend + share price $80

So the dividend investor has some protection against the vagaries of the market. But it’s no one-way street because if the market increases by 25% it will be the dividend investor who loses out. So the dividend investor has downside protection at the cost of the upside potential.

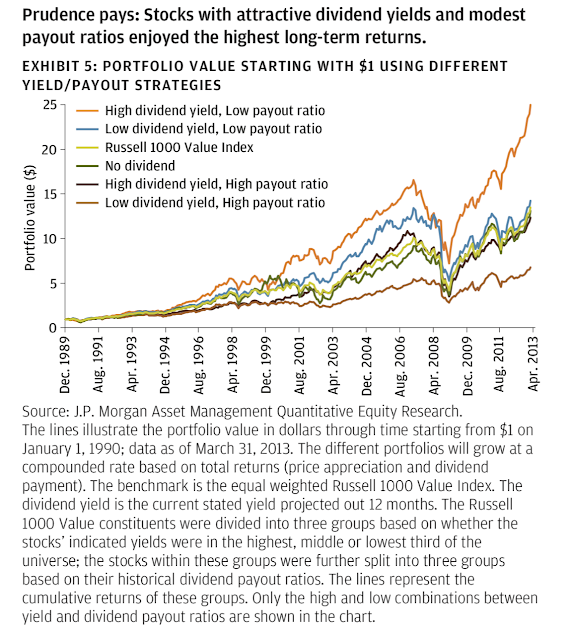

6. You Believe The Research That Dividend Paying Stocks Out-Perform Non-Payers

There is evidence that stocks that pay healthy dividends which are well covered by their earnings outperform the market.

A report by JPMorgan “Dividends For the Long Term” has this as one of its conclusions:-

“Stocks that pay dividends have historically outperformed non-dividend-paying stocks over the long term. Not only are total returns driven by dividend growth over the long term, but dividend-payout policies may also help drive smarter capital-allocation decisions by management.”

However there is a large caveat! The best performers are those that have a high dividend yield combined with a low payout ratio – the dividend is well covered from earnings.

So to summarise why a Retiring on Dividends strategy may work for you:-

- Income not directly linked to market ups and downs

- Easy to implement compared to income drawdown

- Evidence that some dividend stocks outperform non-payers

- Probability of leaving a significant inheritance

6 Reasons Why Retiring on Dividends May NOT Work For You

1. Retiring on Dividends Results in a Lower Income

Firstly it is difficult to construct a portfolio to produce an inflation-linked 3.5% yield (comparable with the income that could be safely taken from a retirement drawdown portfolio).

Secondly, in order to generate the maximum income during retirement, you need to drawdown on capital. Retiring on Dividends results in capital preservation at the expense of income.

Pension drawdown maximizes income during retirement by selling shares to generate income.

2. Dividend Portfolios are More Volatile and Higher Risk

A 100% equity dividend income portfolio will be significantly more volatile than a balanced equity/bond portfolio. The table below from Vanguard USA shows the returns and volatility of bond/equity portfolios from1926-2018. A 100% equity portfolio suffered a worst-case annual decline of 43% and a 40% equity portfolio a fall of 18%.

The investor has to make a trade-off between growth potential and risk (volatility). The dividend investor will normally have a 100% stock allocation which results in a volatile portfolio which exposes the retiree to a greater level of risk than the investor with a balanced portfolio.

3. Dividend Portfolios Aren´t Diversified

It is far easier to achieve a well-diversified portfolio when dividend income is not the determining criterium. A retirement drawdown portfolio can be highly diversified using total market index funds and across different asset classes and geographic regions.

4. Passive Dividend Income Funds Underperform Active Funds

It is well established that few active funds consistently beat the market indices. Many of the best dividend income strategies rely on active portfolio management.

Whilst there are income-orientated passive funds that use set rules to select index membership many of these indices apply simplistic selection criteria with no attempt to qualify the sustainability of the dividend and the growth prospects of the company.

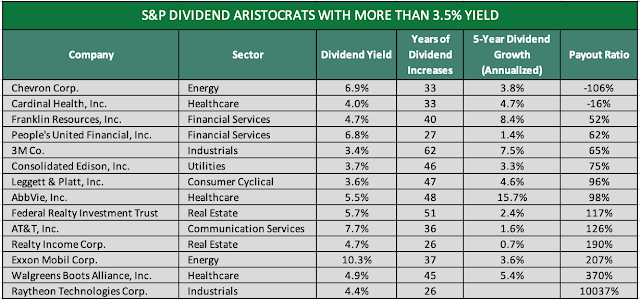

The S&P 500 Dividend Aristocrats is a good example of how a semi-passive section process can result in a portfolio containing many many stocks that would probably not pass muster in an actively managed fund due to their poor earnings coverage of dividends.

The index comprises 65 stocks chosen because they have maintained or increased their dividends for more than 25 years and have a minimum market value of at least $3bn. Of those only 14 have a yield of more than 3.5% (the minimum yield I would accept in an income portfolio). None of these pay less than 50% of earnings as dividends and only 3 pay out less than 75% of earnings. This does not bode well for their total return prospects. In fact, even though the average yield of the 65 stocks is only 2.7% there are still only 19 stocks with better than a 2:1 dividend cover (50% of earnings payout).

Irrespective of whether the investor holds individual shares or holds funds, a higher degree of active management is needed than for income drawdown where passive index funds are likely to outperform active funds and at a lower cost.

5. Dividend Income is Variable

There can be a significant variation in dividend income, in particular from passive funds and ETFs. The graph below showing annual dividends from the SDY dividend ETF illustrates this well.

There are active investment vehicles such as Investment Trusts that by retaining earnings during the good years can smooth out their payments. My Investment Trust Retirement Income Portfolio produced less volatile income but these are actively managed funds with higher management fees than most passive funds and of course, there is no magic in retaining some earnings for the future – most of us have some kind of ¨rainy day¨fund.

6. Dividend Income is Less Tax Efficient

Dividend income is often taxed at a higher rate than capital gains when the holdings are outside of tax-sheltered accounts. This has certainly been true in the USA and in the UK individuals are have an annual tax-free allowance of £12,000. Dividends in the UK over £2000 are taxable.

Conclusions

I found this post particularly difficult to write because my own experiences with dividend investing have been highly positive yet it is difficult to find substantive data to support the case for Retiring on Dividends. On the other hand there are arguments for income drawdown investing based upon extensive data going back over 100 years supported by tools such as Monte Carlo Simulation.

My dilemma is that my SIPP dividend portfolio has returned 75% since 2012 compared with 28% from the FTSE All-Share (dividends reinvested) and my dividends increased by 127% over the same period with a drawdown beating yield at all times (initial yield 4%, current yield 5.5%). This is an actively managed portfolio with all the potential problems that this implies but why give up on something that is working?

The inability to undertake thorough analysis is a great problem when considering the merits of dividend investing. Most portfolios are actively managed so any statistically valid analysis over an extended timescale is virtually impossible. Published papers on the topic have nearly always used a total market data set or are based upon balanced bond/equity portfolios. Neither approaches are valid for the dividend investor and whilst there are some strong qualatitive arguments to support a dividend strategy it is hard to substantiate these with the same quality of data analysis that is available for income drawdown

The quantitative evidence supporting drawdown rather than dividend investing is significant and convincing:-

-

- Portfolio Diversification

- Lower costs

- Higher income

- The ability to personalise the risk/return portfolio profile

- Stability of Income

- Extensive data to allow portfolio optimization

- Potentially tax-advantageous (CGT allowance)

So if one is to be “driven by the data” (I´m sure I´ve heard that a few times lately!) Income Drawdown has to be preferred over Retiring on Dividends. However, to use a cliche “the proof of the pudding……..” as dividend investing has been a great success for me I am backing both horses – at least for the next few years. I will continue with 50% of my retirement portfolio in investments in Dividend Income portfolios based upon Investment Trusts ( “A Better Retirement Income Portfolio – 8 Investment Trusts to Provide Secure Growing Income” ) and the other 50% in balanced drawdown portfolios.