It’s finally time to say goodbye to my Investment Trust Dividend Portfolio!

I have always viewed my Investment Trust Dividend portfolio as a medium-term strategy to provide protection against sequence of return risk during the early years of retirement and to give a higher initial income (more than 5%) than would be wise to take from a total return drawdown portfolio (3.5% to 4%). It was always my intention to liquidate the portfolio at some stage and convert to a passive total return strategy to simplify the management of my investments as dividend investment requires active management. I was planning the change for 5 to 10 years into retirement but the decision has been brought forward as the purchase of an annuity to take advantage of the very attractive rates in 2023 has increased my income to a level that I am in the fortunate position to have more income than I need short to medium term. So I haven’t been spending the tax-free dividends (it`s an ISA portfolio) just reinvesting outside of the ISA tax wrapper. Not a very sensible strategy! The obvious solution is to just reinvest the dividends within the ISA. However, the obvious solution isn`t always the best as I will show a bit later in the post.

Why a Dividend Portfolio Rather than Going For Total Return?

I`m not going to revisit the arguments pro and contra “retiring on dividends”. I have written several posts looking at this. In my case, I built a portfolio of income Investment Trusts that had a history of maintaining or increasing dividends and that had sufficient reserves to see them through any difficult market conditions. I wanted to avoid the problems of the sequence of return risk that can result when a retiree with a total return portfolio has to sell off shares at knock-down prices during a stock market collapse. This can be particularly harmful during the early years of retirement. This strategy was validated during the dividend crisis of 2020 as the portfolio continued to produce increasing dividends, despite a hit on the value of the the portfolio.

However, running a dividend income portfolio long-term conflicts with my objective to simplify my investments to virtually run on “auto-pilot”. This is to avoid the potential consequences of cognitive decline which may be undetectable in the early stages but can result in very poor decision making. I`m sure most readers will have heard the terrible stories of educated, intelligent, and apparently mentally alert investors falling for fraud and being so confident of their decision-making capabilities that they ignored all warnings.

Before retirement, I had a portfolio of over 60 shares across 4 brokers. I have spent the last few years reducing this to a 2-fund drawdown portfolio with one broker and a 12-fund income portfolio with another. Dividend portfolios are active, they require supervision and maintenance. Even a portfolio of Investment Trusts cannot be left unattended. The underlying Investment Trusts are actively managed and managers change, the style of a manager can change (e.g. Neil Woodford) and the objectives of the trust can change.

My only outstanding action is the conversion of the IT Dividend portfolio to a simple passive index-based total return portfolio. This will simplify my finances to an extent where in just one paragraph I can instruct my family on how to manage my investments.

How has The Portfolio Performed?

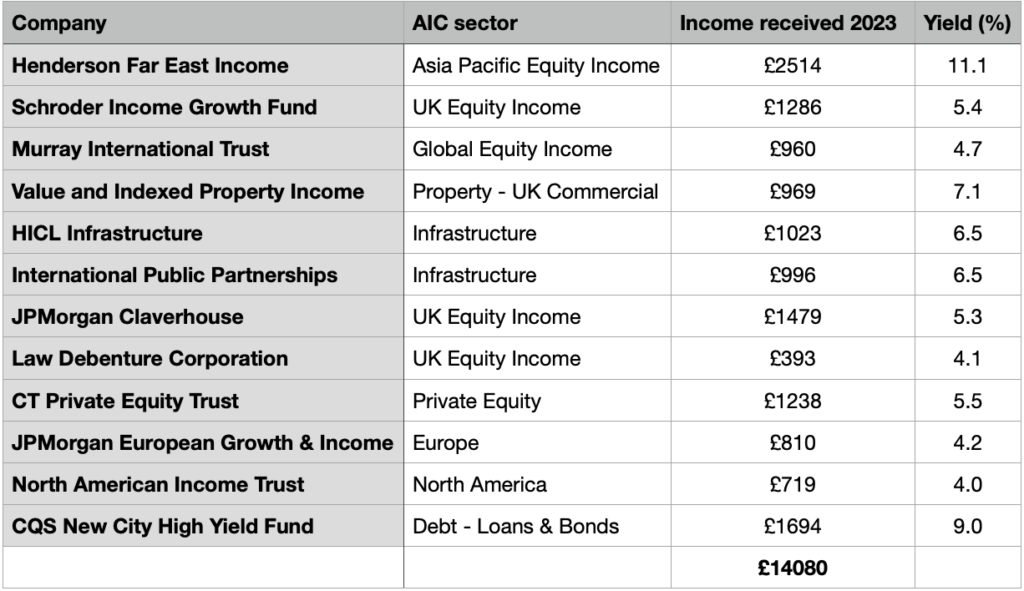

The portfolio is shown in the table below and 2023 produced a total tax-free income of £14,080 representing a yield of 6.2%.

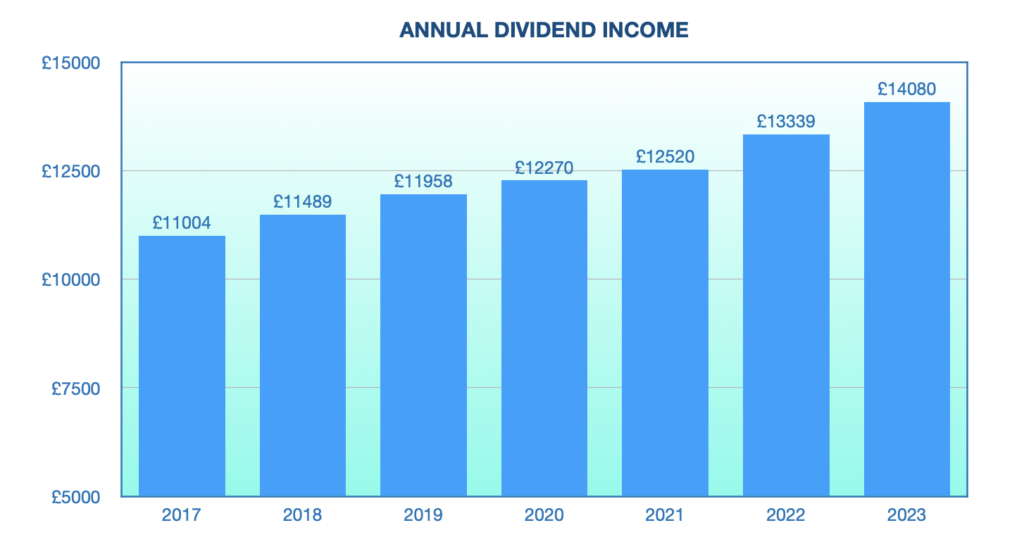

Dividends increased by an annuañised rate of 4.2% from 2017 to the end of 2023. This compares with an annualised c.p.i. increase of 3.96%.

Portfolio Performance (Dividends Reinvested)

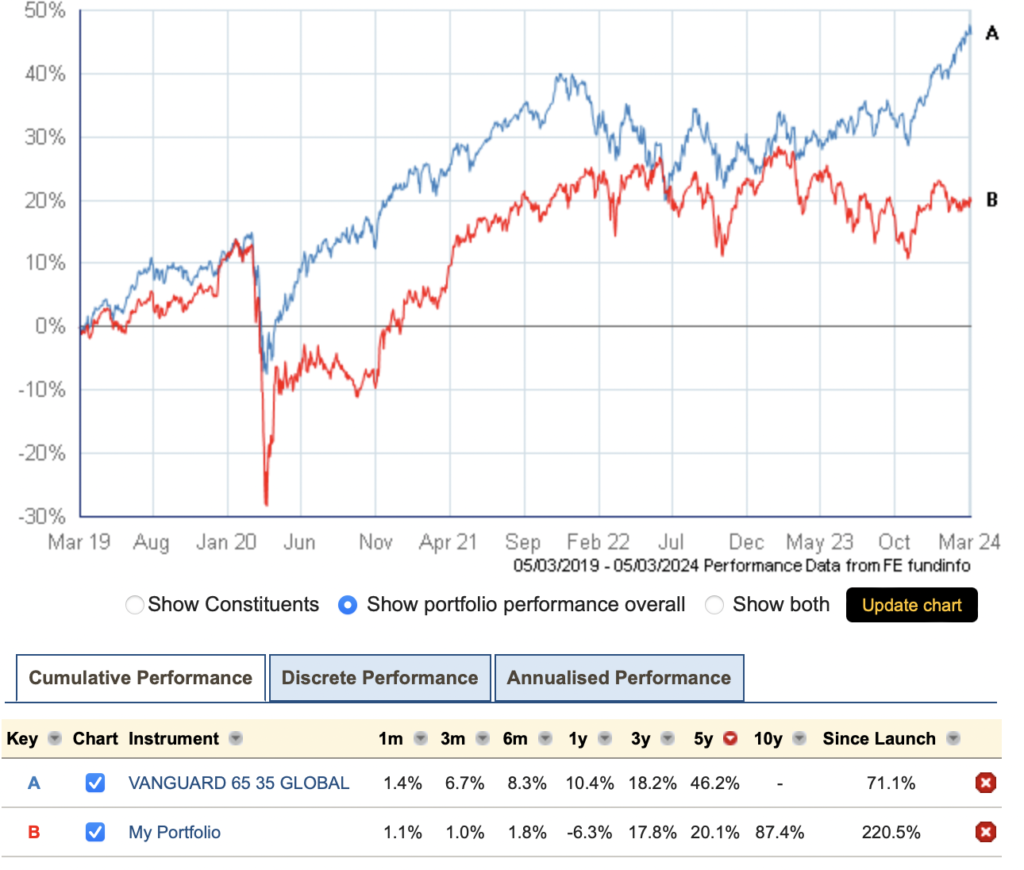

The graph below compares the performance of the IT portfolio with the FTSE All Share Index and VanguardLifeStrategy 60/40 fund. Over 10 years the IT portfolio outperforms the FTSE All Share Index and equals that of Vanguard’s LifeStrategy Fund. The last 12 month`s performance has been far poorer hit by the decline in valuations of income trusts in general as high interest rates have made them unattractive compared with government bonds.

Dividends are No Free Lunch!

Without dividend reinvestment, the value of the portfolio increases by 15.7% over 10 years compared with 87.4% had dividends been reinvested. In real terms, this is a reduction of nearly 25% in its value. In certain respects, this isn`t a bad result for a retiree as it is a means of using capital during retirement in a similar way to a drawdown portfol¡o which also assumes a reduction of the capital value of the portfolio. Retiring on dividends allows for a graceful decline in portfolio value, a less visible erosion of capital than with a total return portfolio where the retiree will see a reduction in the number of units or shares he holds. It is however an illusion to be reassured to have the same value portfolio towards the end of retirement as an investment of £100,000 will only have a real value of about £30,000 at the end of 30 years assuming historical UK inflation rates.

Reinvesting Dividends or Adopting Total Return Approach?

Given that I don`t need the dividend income at the moment but will at some time in the future and the annuity income is eroded by inflation the issue is whether to maintain the existing IT portfolio or to sell up and invest in a passive total return portfolio similar to the drawdown portfolio I already have.

Certainly comparing the performance of my IT Portfolio with a two-fund equity/bond portfolio the answer is pretty clear from below which compares the performance of a total return portfolio of 65% Vanguard FTSE Global All Cap and 35% Vanguard Global Bond Index with the Investment Trust Income portfolio (with dividend reinvestment). The total return portfolio has higher growth and lower volatility and is simple to administer. I am happy to allow the bond holding to vary between 30% and 40% as there is only a small difference in performance and volatility within this range of bond holding.

Why Not A Multi-Asset Fund Such as Vanguard`s LifeStrategy?

There is a strong argument to say that to simplify investments then it would be better to go for a multi-asset fund such as Vanguard`s LifeStrategy fund to have no worries about having to periodically re-balance. However, having separate holdings of equities and bonds gives the option if there is a market crash to sell off bonds in preference to equities – either deriving 100% income from bonds or just increasing the take from bonds. Even though drawdown theory says that if the market crashes you can just sail on regardless, still taking the same inflation-linked income and with no change in your investment or spending strategy. This doesn’t seem very likely to me! In a severe market downturn, most retirees would certainly reduce their drawdown income to a minimum and avoid selling equities. So a two-fund equity/bond portfolio offers simplicity and versatility and it is surprising that despite the large number of complex portfolios that are publicised and often promoted by advisers the classic 60/40 bond/equity portfolio still offers one of the highest Safe Withdrawal Rates.

A frequent criticism of LifeStrategy is its UK bias of 20%+ compared to 5% or so in a Global Index. Modern portfolio theory says that the ideal is to own all of the market on a capital value-weighted basis. This view is widely promoted in the press and social media and whenever Vanguard`s LifeStrategy funds are considered they are criticised for their home market bias. This downvoting of home bias is now being questioned in knowledgeable circles and I was surprised and somewhat baffled when using both timeline.co and portfoliovisualizer.com for simulations that if the UK content of a global portfolio is increased to around 25% then the Safe Withdrawal Rate improves. This merits some more investigation.

Now It`s Done!

A month ago the IT portfolio was liquidated and invested in an IWeb ISA, 35% Vanguard Global Bond, and 65% in Vanguard FTSE Developed World, both are ETFs. My other total return portfolio with Vanguard has the equity portion in the FTSE Global All Cap fund. In a previous post, I analysed the main global index funds and couldn’t come to any solid conclusion as to the best index. In theory, the FTSE Global All Cap should be the go-to fund but the downside of its greater diversification and therefore lower US holdings has been its underperformance over the last 5 years. The best-performing index has been the one with the greatest US weighting – the FTSE Developed Word index. It`s anyone’s guess what the future will bring so I am covering my options by going for the FTSE Developed World. I am sticking with Vanguard ETFs in case I want to do an in-specie transfer to my account at Vanguard at a later date. I highly value their facility to do automatic monthly drawdown.