Pension academics have been asking the same question for decades. From a theoretical perspective of how to maximise financial utility during retirement the answer has been an annuity.

During the recent epoch of super low interest rates there has been a very simple answer to the question of why not? The payouts have been far lower than can reasonably be expected from income drawdown. An inflation-linked annuity for a couple would pay out around 3% (£3000pa for a £100k purchase) whereas income drawdown would pay 3.5% to 4% with a 90% likelihood of providing a chunky inheritance.

Today with the sharp rise in gilt yields the situation is very different. A couple of around 60 years of age can purchase an RPI-linked annuity paying over 3.5%. A single retiree can obtain 5% or more or over 7% with no inflation linking.

When one considers that an optimistic Safe Withdrawal Rate (SWR) from a drawdown portfolio is 4%, and a conservative rate is less than 3.5% then an annuity is a very attractive option providing you aren’t committed to the idea of leaving some of the pension pot as an inheritance.

Retirees With a guaranteed Income are Happier

Research shows that retirees who have their income guaranteed not only are happier but spend more. Perhaps this is the only time in one`s life that you should maximise spending to enjoy it whilst you can. Not surprisingly, retirees who rely on income from their investments under-spend due to fear of exhausting their investments. Having a large proportion of income in the form of government pension, annuities, and defined benefit pensions gives a retiree peace of mind and they can spend more freely than a retiree who depends on investment performance for income.

Level or Inflation Linked Annuity?

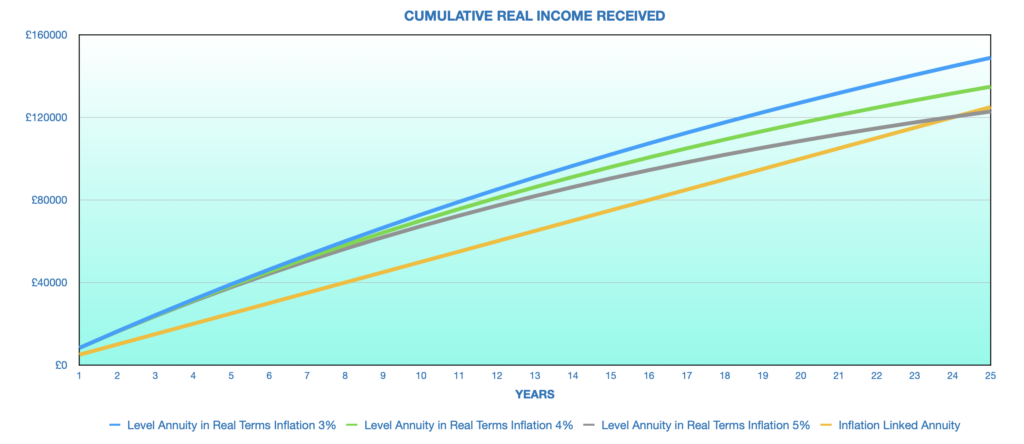

There are two factors to evaluate; (i) annual income – how long it takes before the income from an inflation-linked annuity exceeds the income from a level annuity (ii) How long does it take before the total real income received from an indexed annuity exceeds that from a fixed annuity.

The UK’s historical inflation rate over the last 50 years is 4.1%. As shown below if future inflation is at this level then in terms of annual income you`ll be better off with the inflation-linked annuity after 14 years at 4% inflation and in 11 years at 5% inflation:-

-

-

-

- 3% Inflation 18 Years

- 4% Inflation 14 Years

- 5% Inflation 11 Year

-

-

However, the situation isn`t quite as clear as it would at first seem as shown in the graph below which looks at the total “real” income received over the years. This is income adjusted for inflation as £1000 of income today will have far more purchasing power than £1000 in 20 years.

As the graph shows even if annual inflation averages 5% it takes 24 years before the total real income received from the inflation-linked annuity matches the total real income received from a level annuity. And over the important “high spending” first ten years of retirement the level annuity produces 40% more inflation-adjusted income than the indexed linked annuity.

Conclusions

For the first time in more than a decade annuity rates are attractive and can be a real and superior alternative to pension drawdown. For a single person, an inflation-linked annuity paying 5% or more beats the 3.5% or so Safe Withdrawal Rate (SWR) of drawdown, and it`s completely safe. No worries about stock market performance and whether one will outlive the portfolio. Joint life annuities offer rates that are comparable to drawdown SWRs but again without the worries of market performance and longevity.

Many retirees hate the idea of signing away their savings, maybe dying early and “losing” their investment and not leaving behind an inheritance. An important role of an annuity is to provide insurance against living too long. A retiree with limited funds may have to accept that he cannot have the maximum possible safe income that only an annuity can provide combined with the possibility of being able to provide an inheritance from his retirement savings. Of course, for many retirees, the biggest inheritance they are likely to leave is their house.

A retiree with sufficient assets can opt for partial annuitisation so there is the possibility of having funds available for the heirs whilst being able to have a higher safe income during retirement. In the case of partial annuitisation there is also the prospect that the higher income provided by an annuity can reduce the drain on other assets and partly compensate for the reduction in inheritance funds.