Even a 5% gold holding in a pension drawdown portfolio can reduce its volatility more effectively than government bonds and increase the Safe Withdrawal Rate by up to 0.5% for every 5% of gold held in the portfolio. A typical UK portfolio of 60% equities and 40% gilts had a historical 3.4% Safe Withdrawal Rate (SWR) after charges. Substituting 5% of the gilt holdings for 5% gold increases the SWR by a full percentage point to 4.4%% and this increases to 5.6% with 20% gold.

This post looks at the potential role of gold for retiree investors in more depth.

Gold is the Marmite of Asset Classes. Some Investors Love it Others Hate It

Warren Buffet, probably the World´s most successful investor is no fan of gold and has spoken disparagingly about it as an asset:-

“gold gets dug out of the ground in Africa… Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

Gold as a Currency

The Investment Case for Gold

Perhaps not unsurprisingly the organization entrusted with promoting gold, The World Gold Council, presents a strong investment case for gold. It identifies some unique characteristics of gold as an asset class that makes it a valuable portfolio diversifier:-

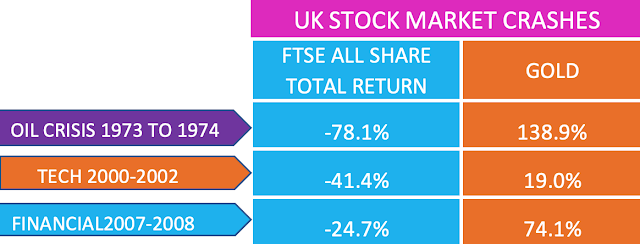

Negative correlation with the stock market during market crashes – as a traditional flight to safety asset gold increases in price when the stock market is in crisis

Positive correlation with a rising stock market – this would seem to contrary to its negative correlation above but the argument is that during good times gold demand for jewelry and industry increases. They state average annual returns over the last 50 years have averaged 11%, comparable to equities.

High Liquidity – gold trading volumes exceed those of Treasury Bills and UK gilts and at an average of £131bn per day during 2020 are similar to volumes of the S&P500.

Inflation Protection – the purchasing power of gold has outperformed all major currencies

Analysis is Handicapped by Limited Historical Data

Does Gold Justify The Claim of Negative Correlation with the Stock Market?

How Does Long-Term Growth of Gold Compare with Stocks?

The table blow looks at the performance of gold over each decade form 1970 compared with the S&P500 (total return). The negative correlation between stocks and gold is clear to see but it´s not possible to draw any conclusions about relative growth rates:-

Bonds or Gold for Portfolio Protection?

Can Gold Be a Worthwhile Addition to a Portfolio?

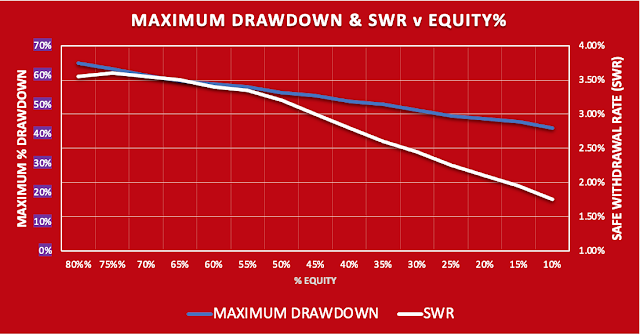

The dilemma that investors are faced with is clearly illustrated in the graph below that shows the variation of Maximum Drawdown (the maximum fall in the value of a portfolio) and Safe Withdrawal Rate (SWR) with changes in the equity content of a portfolio:-

(UK portfolio of the total stock market and 15-year gilts 1970 to 1990, 30 year retirement periods)

The maximum Safe Withdrawal Rate (SWR) is obtained with 65% to 75% in equities but this also coincides with the maximum drawdown (decline) of up to 60%.

Many retirees would be very unwilling to accept such a drastic fall in the value of their retirement savings. Increasing the bond holding in the portfolio isn´t an effective solution either, as with only 40% in equities the SWR falls to 2.8% – a 20% reduction in a retiree´s income yet the portfolio will still be subject to a potential 50% decline in value during a market crash. Reducing volatility and drawdown by weighting the portfolio towards bonds has a high price and is not that effective. This is where gold comes into play.

Gold in a Portfolio

CONCLUSION

Based on the last three market crashes gold can significantly protect a portfolio from severe market downturns and is more effective in this than holding government bonds. Perhaps more significant for retirees in drawdown is that as little as 5% of gold in a drawdown portfolio will increase the maximum amount that can be safely drawdown as retirement income and allow the equity content of a portfolio to be reduced without greatly reducing its income potential.

The US started the end of pegging the US$ to gold in the late 1960's, officially making the break in 1971, as a means to help pay down the cost of the Vietnam war. When pegged at a fixed/constant exchange rate (pre 1970's) it made more sense to hold money deposited and earning interest that could then be exchanged into gold as/when desired. If the money was deposited into Treasury bonds/bills then that was like the state paying you for it to securely store your gold. As such the correct measure of the value/gains in gold might be considered as T-Bill interest rates pre 1970's and gold prices since then.

Another factor to consider is that in the likes of India where state currency is less trusted due to devaluations/defaults, a common preference is to hold gold and convert that to currency as/when required. There's a liquid/easy market to use gold as collateral in exchange for money/cash, a bit like a pay day loan, and then later pay back the money + some interest, typically around 0.75%/month in order to have their gold returned. For the other party who might like to hold gold as part of their portfolio, such gold collateral can be considered as being on their books during the period of the loan, and where that gold is earning interest (0.75%/month). Typically they only lend cash amount to 70% of of the spot price of gold, so if the loan is defaulted they keep the gold and in effect 'bought' such at a 30% discount.

Buffett's oft repeated statement about gold is akin to saying that buying a farm and leaving it idle is wasteful. Work the farm and it can produce dividends. Trade (volatile) gold since the 1970's and it can produce dividends. A reasonable method to trade gold is to barbell it with stocks, two polar opposites that combine in a similar manner to how a 1 year and 20 year Gilt barbell combines to be like a central 10 year bond bullet. US data, but similar for the UK https://tinyurl.com/3y4ej4u9

Really insightful comments Seajay. So would you hold gold and if so how much?