Whilst a good rule of thumb the 4% Withdrawal Rule will fail to maximise the income of retirees. Many will die leaving large legacies when they could have enjoyed a far higher income during retirement. Many retirees will also through fear of running out of money withdraw far less from their retirement portfolio than the safe maximum. Variable Withdrawal strategies tackle the deficiencies of the 4% Rule by providing a set of rules to indicate how much money the retiree can safely withdraw.

The Problems With The 4% Rule

Without a doubt, William Bengen´s research which culminated in the 4% Rule in the 1990s revolutionised retirement planning. Bengen proved that historically a US retiree could take an initial income of 4% from his portfolio and increase this by the rate of inflation for 30 years and not run out of money.

An Inflation-Linked Income May Not Be The Ideal

-

-

- Real levels of spending were maintained during the first decade followed by spending falling in real terms.

- “Smiley Face” spending – initial real spending levels reducing to a minimum then increasing due to medical and welfare costs.

-

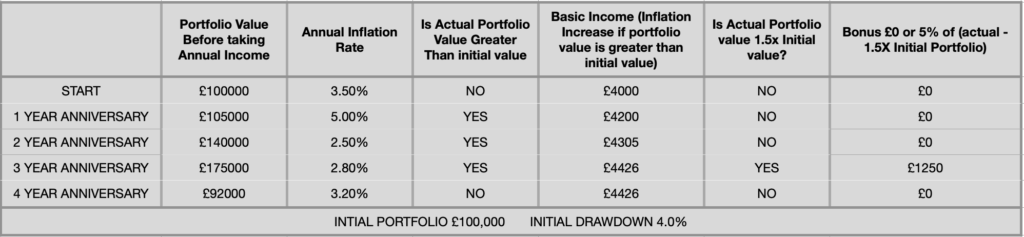

Variable Withdrawal

-

- Select an initial withdrawal rate. For the UK 2.5% to 4% and US 3% to 4.5%.

- Withdraw the first income at the start of retirement

- At every annual anniversary:-

- If the portfolio value is greater than the initial portfolio value then increase the income withdrawal by the rate of inflation. If not greater withdraw the same amount as the previous year

- If the actual portfolio value is 1.5 times the initial portfolio then take a bonus of 5% of the difference between the actual and initial portfolio value.

Comments:

-

- The initial withdrawal rate has little effect on the total income received during retirement but the higher the rate the more income received during the first 15 years.

- The bonus is optional. If you don´t take the bonus the final legacy will be higher.

- The income will not reduce in nominal terms but may do so in real terms.

- The strategy has been tested on 35-year retirements from 1920 to 1985 for the UK and US based on a 60/40 equity/bond portfolio with costs assumed at 0.3%.

- Increasing the equity proportion increases the income received and the final portfolio balance.

Simulation Results

UK

A Higher Margin of Safety

US Data

Comments on US Data

-

- The US Bengen safe withdrawal rates are significantly higher than those for the UK (US Bengen 3.85% v 3.1%)

- The US MaxVar SWR is slightly higher than that of the UK (4.5% v 4.4%).

- Optimum SWRs for Bengen and Max-Var are 40% to 60% and the SWR for MaxVar declines with equity content over 50%.

- Income from MaxVar is on average 40% higher than from Bengen (70% higher in the UK).

Conclusions

Of all the strategies related to retirement income drawdown that I have researched Variable Drawdown is the one that excites me the most and is the strategy most likely to align retirement income with spending patterns. It has the potential to:-

-

-

- Provide greater safety from the sequence of return risk

- Produce more total income than the classic Bengen inflation-linked income

- Produce more income during the first years of retirement

- Offer a higher Safe Withdrawal Rate than Bengen

- Allow the retiree to balance income against potential legacy

- Automatically adjusts income to portfolio performance

-

There is a multitude of different variable drawdown strategies available which are well documented and analysed and which may be preferred by some retirees. My own MaxVar system appeals to me due to its simplicity and robustness and historically there are very few retirement periods where the retiree would have received more income by adopting a Bengen-style withdrawal plan.

Why use / refer data to 1985 only, the last 38 years surely is more relevant.

1985 is the retirement year for a 35 year duration retirement ending in 2020.

I have spent the last 3 weeks researching methods for withdrawing retirement savings (I’m in the US, BTW). I am now convinced that the Bengen rule will not work for me, especially given the way my portfolio has looked for the last 2-3 years. I’m intrigued by the Guyton-Klinger Guardrails approach, but like you, I’m wondering how many calculation hoops I have to jump through (or ask someone else to jump through) to achieve the results I want. Your approach sounds like something I can do relatively easily, but I have a question about the annual adjustments. You say “At every annual anniversary:- If the portfolio value is greater than the initial portfolio value then increase the income withdrawal by the rate of inflation. If not greater withdraw the same amount as the previous year”. When you say “withdraw the same amount as the previous year,” do you mean use the same Rate of Withdrawal, e.g., 4%, as the previous year? Or the same amount of money, e.g., $40,000, regardless of that amount’s percentage of the total portfolio at the time of withdrawal? (Thanks for your attention).

HI Linda, you just maintain or increase the monetary value that was paid the previous year. There is an excellent discussion about all aspects of retirement income in the latest podcast from Rational Reminder.