In the previous post “6 Reasons Why Retiring on Dividends Could Right For You” I looked at why Retiring on Dividends could be a good strategy for some retirees. Here I look at why it might not be the ideal retirement income plan.

1. Retiring on Dividends Results in a Lower Income

To receive the maximum income during retirement you need to drawdown on capital. Retiring on Dividends results in capital preservation at the expense of income.

However, all is not lost for retirees in drawdown interested in leaving an inheritance for their heirs. Statistically, over 90% of retirees in drawdown will not use up all of their portfolios and will have a balance available to pass on so drawdown may still offer a similar inheritance benefit as Retiring on Dividends. This unfortunately is also one of the downsides of drawdown – fear of market downturns and concern about outliving the portfolio results in most retirees taking a too conservative an income.

Pension drawdown maximizes income during retirement by selling off shares to generate income.

2. Dividend Portfolios are More Volatile and Higher Risk

A 100% equity dividend income portfolio will be significantly more volatile than a balanced equity/bond portfolio. The table below from Vanguard USA shows the returns and volatility of bond/equity portfolios from1926-2018. A 100% equity portfolio suffered a worst-case annual decline of 43% and a 40% equity portfolio a fall of 18%.

The investor has to make a trade-off between growth potential and risk (volatility). The dividend investor will normally have a 100% stock allocation which results in a volatile portfolio which exposes the retiree to a greater level of risk than the investor with a balanced portfolio

3. Dividend Portfolios Aren´t Diversified

It is far easier to achieve a well-diversified portfolio when dividend income is not the determining criterium. A retirement drawdown portfolio can be highly diversified using total market index funds and across different asset classes and geographic regions.

There is a multitude of well-researched portfolios available for the drawdown retiree ranging from the classic 60/40 bond/equity portfolio to portfolios with 10 or more constituents incorporating equities, bonds, cash, real estate, and commodities.

Multi-asset funds such as the Vanguard LifeStrategy range and target-date retirement funds

simplify tasks such as portfolio rebalancing for the drawdown retiree.

4. Passive Dividend Income Funds Under-perform Active Funds

It is well established that few active funds consistently beat the market indices. Many of the best dividend income strategies rely on active portfolio management.

Whilst there are income-orientated passive funds that use set rules to select index membership many of these indices apply simplistic selection criteria with no attempt to qualify the sustainability of the dividend and the growth prospects of the company.

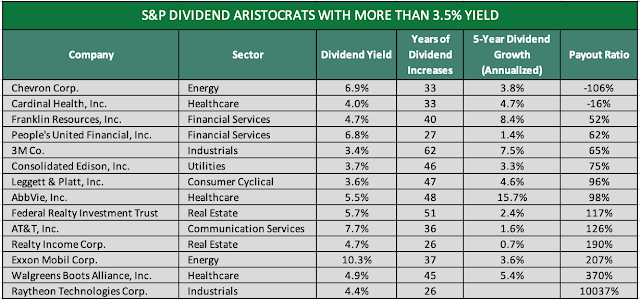

The S&P 500 Dividend Aristocrats is a good example of how a semi-passive section process can result in a portfolio containing many many stocks that would probably not pass muster in an actively managed fund due to their poor earnings coverage of dividends.

The index comprises 65 stocks chosen because they have maintained or increased their dividends for more than 25 years and have a minimum market value of at least $3bn. Of those only 14 have a yield of more than 3.5% (the minimum yield I would accept in an income portfolio). None of these pay less than 50% of earnings as dividends and only 3 payout less than 75% of earnings. This does not bode well for their total return prospects. In fact, even though the average yield of the 65 stocks is only 2.7% there are still only 19 stocks with better than a 2:1 dividend cover (50% of earnings payout).

5. Dividend Income is Variable

There can be a significant variation in dividend income, in particular from passive funds and ETFs. The graph below showing annual dividends from the SDY dividend ETF illustrates this well.

There are active investment vehicles such as Investment Trusts that by retaining earnings during the good years can smooth out their payments. My Investment Trust Retirement Income Portfolio produced less volatile income but these are actively managed funds with higher management fees than most passive funds and of course, there is no magic in retaining some earnings for the future – most of us have some kind of ¨rainy day¨fund.

6. Dividend Income is Less Tax Efficient

Dividend income is often taxed at a higher rate than capital gains when the holdings are outside of tax-sheltered accounts. This has certainly been true in the USA and in the UK individuals are have an annual tax-free allowance of £12,000. Dividends in the UK over £2000 are taxable.

A fascinating discussion is definitely worth comment. I believe that you ought to publish more on this subject, it might not be a taboo subject but usually people do not discuss such topics. To the next! Many thanks!!