Is Gold a 100% Irrational Investment?

Warren Buffet famously said “Gold gets dug out of the ground in Africa, or someplace. Then we melt it down, dig another hole, bury it again and pay people to stand around guarding it. It has no utility. Anyone watching from Mars would be scratching their head.”

and who can argue with him when he says:- “I will say this about gold. If you took all the gold in the world, it would roughly make a cube 67 feet on a side…Now for that same cube of gold, it would be worth at today’s market prices about $7 trillion – that’s probably about a third of the value of all the stocks in the United States…For $7 trillion…you could have all the farmland in the United States, you could have about seven Exxon Mobils (NYSE:XOM ) and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67-foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils.”

) and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67-foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils.”

) and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67-foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils.”

) and you could have a trillion dollars of walking-around money…And if you offered me the choice of looking at some 67-foot cube of gold and looking at it all day, and you know me touching it and fondling it occasionally…Call me crazy, but I’ll take the farmland and the Exxon Mobils.”Yet knowing this I have just invested in gold. Am I completely mad to go against the advice of the world´s most successful investor? I have no doubt that for a long-term investor there can be no better investment than putting your money into high-quality companies that will benefit from global growth and the explosion of the new middle classes in developing nations such as India, China and Africa. The world is getting richer and the better companies will be able to prosper from this growth.

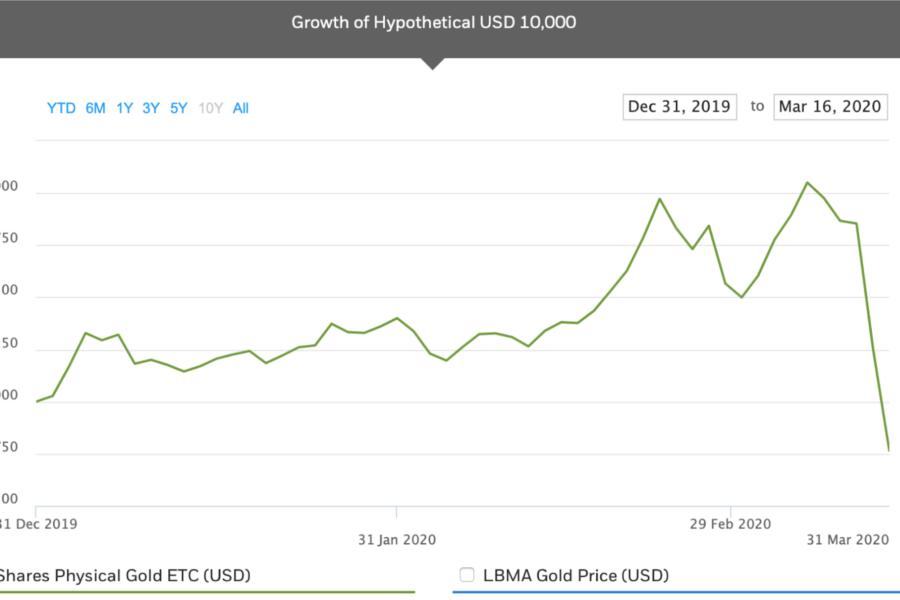

However, for a retiree, all is not about portfolio growth. Volatility can be a portfolio killer during a downturn and gold as an asset uncorrelated with the stock market can reduce the volatility of one´s portfolio and permit a higher safe drawdown rate than would be advisable with a conventional share and bond portfolio. So gold will form 25% of my Permanent Portfolio via the Ishares Physical Gold ETF and only time will tell if I am indeed a fool.