This is my Permanent Portfolio:-

|

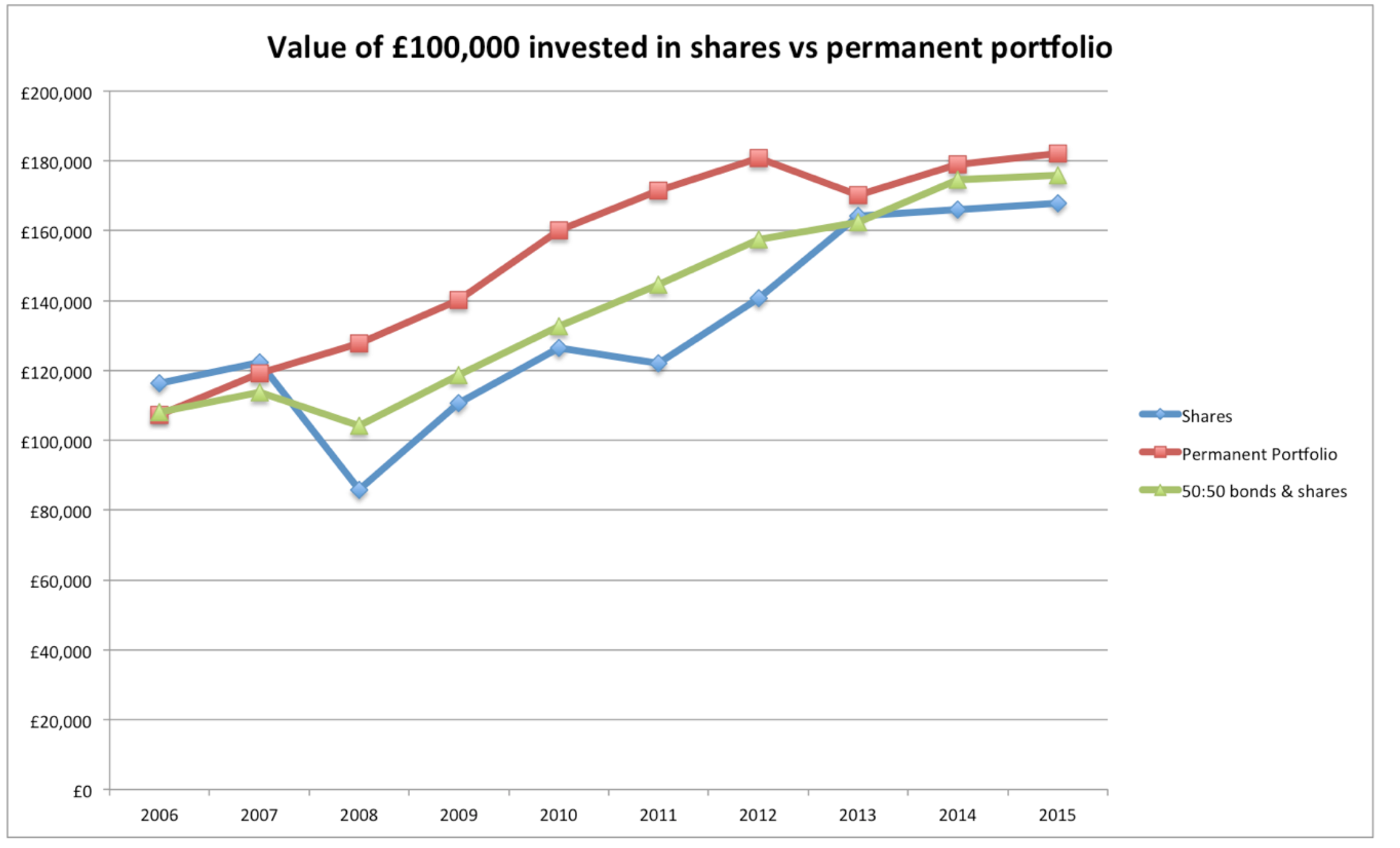

5 Year Permanent Portfolio v FTSE All Share |

Background

In a previous post, I took a look at The Permanent Portfolio and concluded that I would create one to complement my income portfolios. Whereas I expect the capital value of my income portfolios to be volatile I would like to have part of my investments to be capital protected with the prospect of inflation+ growth. The Permanent Portfolio should meet that goal – of course, the proof of the pudding …

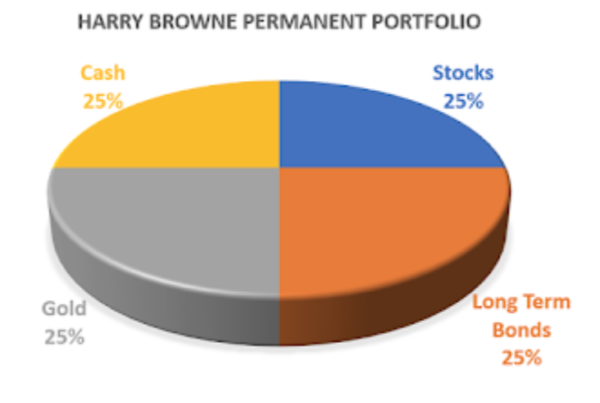

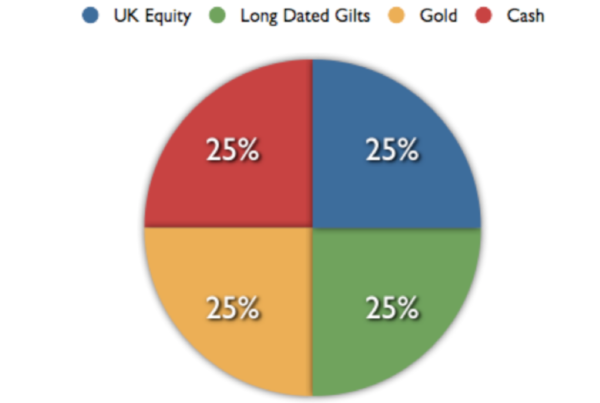

There are four equally split asset classes in the Permanent Portfolio in the original Harry Browne proposal – gold, equities, long-term government bonds, and cash. harry Browne subsequently suggested some variation in assets to the Permanent Portfolio and both the PERM ETF and PRPFX Fund have deviated from Browne´s original asset allocation. I am sure this is the result of significant backtesting but for me, it moves away from the elegant simplicity of the original portfolio – so I´m going for simplicity in my implementation.

|

PERM PERMANENT PORTFOLIO ETF |

|

PRPFX PERMANENT PORTFOLIO FUND |

SECURITY

GOLD

LONG TERM GILTS

CASH

Great post. My only comment is that Harry Browne recommends to hold the permanent portfolio in the same currency. Your gilts are UK based. However your sahres are global. There could be an scenario where the shares globally go down but the UK gilts do not protect you…..

Congratulations for your blog. Just found it and it is amazing. Do you have a suscribe/email option?