The FIRE movement (Financial Independence Retire Early) has with great success delivered a simple message:-

“build a portfolio that is equal to 25 times your annual expenses and you will achieve financial independence”.

This just will not work and historically hasn`t worked for many investors. In particular, there is an assumption amongst some UK investors that they can copy a US-based portfolio and obtain an identical Safe Withdrawal Rate (SWR). It just doesn`t work like that due to differing inflation rates and currency fluctuations. In practice, the UK investor will end up with an SWR at least 0.5% lower than his American counterpart. Yet the myth of 25 times expenses is still perpetuated by the FIRE movement and taken as Gospel by mainstream media.

Origin of the 25 Times Rule of Thumb

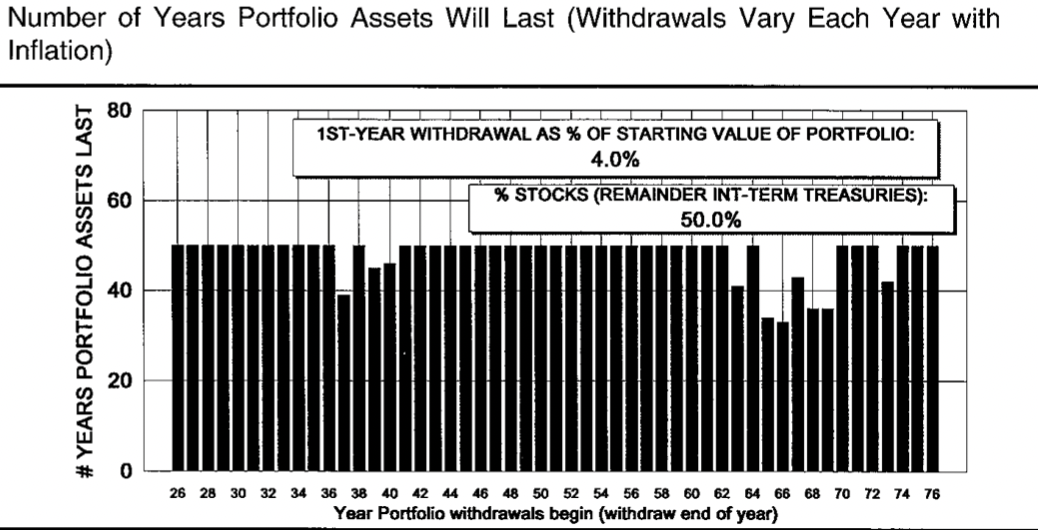

The factor of 25 times is derived from William Bengen`s 4% Rule which arose from his paper of 1994 which showed that a US Retiree starting retirement any year from 1926 onwards with a 50/50 equity/bond portfolio could have withdrawn an initial 4% of his portfolio and then adjusted this for inflation annually and he would not run out of money during the next 30 years. The 1998 Trinity Study subsequently broadly confirmed these findings.

This graphic from Bengen`s paper above shows that 78% of the portfolios of retirees would have lasted at least 50 years and that all would have survived 30 years.

Now that FIRE has passed from niche to mainstream the 25 times figure or 4% is often quoted on the BBC and other media channels as being an unquestionable fact. During a recent podcast on FIRE by the FT`s Claer Barrett she interviewed Kristian Danielson who is behind/FIREUK subreddit. He stated that if an index fund averaged 7% annual long-term growth that one could simply leave 3% on the table to allow for inflation and withdraw 4% as income. No thoughts about the biggest elephant in the room for drawdown retirees “Sequence of Return Risk”.

25 Times Expenses is a far clearer message than talking about percentages which often confuse audiences. I am sure the apostles of FIRE well understand that the true message should be that 25 times or 4% would have worked for some past retirees but that you are not going to gamble your retirement prosperity on “there`s a fair chance it will be OK”. However, there are now many vested interests in making FIRE attractive, bloggers, podcasters, and YouTubers all earning increased revenue by growing their audience. So none of them are going to say it’s not 25 times expenses but nearer 40 times or that you need an income of £60k plus to stand a chance of anything but a very lean FIRE.

The 25 times message is easy to understand and seemingly attainable. Almost a form of Click Bait to draw you in. Rather like the infamous Brexit Bus. A simple message but perhaps not completely true!

So What is The Truth?

-

-

- The Bengen and Trinity studies are based on 30-year retirements. A FIRE retirement is likely to be 50 years or more. In fact, Bengen does look at a 50-year retirement in his paper and found that only a 3% withdrawal rate would have ensured 100% success

- Bengen does not include broker and fund fees in his calculation. 0.4% in expenses reduces the SWR by around 0.2%

- For the US retiree with a 50% total US market, 50% Intermediate Treasuries Monte Carlo Simulation using PortfolioVisualizer for a 60-year retirement shows that the SWR for 95% success is 3.1% – excluding expenses.

- The FIRE movement does not make clear that the 25 times annual expenses target is based upon your expenses at the time of “FIREing”. So if you have £20k of expenses when starting the FIRE journey this does not mean you just need 25 x £20K (£500k) to achieve financial Independence. This must be adjusted for inflation. So if the target FIRE date is in 20 years’ time and inflation averages 3% you will need to aim for £500k x (1.03)ˆ 20=£903k and if inflation hits 5% you will need £1.333m.

- Taxes: the FIRE target assumes income is tax-free. Certainly, in the UK there are tax-exempt vehicles such as ISAs which allow both tax-free portfolio growth and tax-free withdrawals. With careful planning, tax liability can be reduced, in some circumstances to next to zero (see my £40K/year tax free plan). However, the majority of investors will use pension savings as their principal savings channel due to the tax incentives during the accumulation phase. But once income is taken this is subject to normal income tax rates. Combine this with a taxable UK State pension then there will be a tax liability which increases the portfolio size necessary to achieve FIRE.

- UK retirees have lower Safe Withdrawal Rates (SWR) than their USA cousins. A large part of this is due to differing inflation rates. The USA had a 3.7% inflation rate from 1960 to 2022 compared to 5.03% in the UK (WorldData). The UK retiree cannot simply invest in the same securities as a US investor and achieve the same SWR due to differing inflation rates and currency fluctuations. For instance, using the Timeline Monte Carlo simulation a UK investor with a 50/50 total US stock market and aggregate US bond market portfolio would have had a 2.9% SWR with a 95% success rate for a 50-year retirement. Portfolio Charts also clearly shows the lower UK SWR: a US investor with a 50/50 US equity/bond portfolio has a Perpetual Withdrawal Rate (the portfolio never runs out) of 3.3% but the UK investor with identical holdings has a PWR of 2.6%.

-

Conclusion

Judging by Reddit posts many early retirees recognise the reality of needing lower withdrawal rates with 2% to 3% frequently quoted as being the percentages used. Of course, the actual FIRE retirement process is far more nuanced due to the contribution of state pensions and tax liabilities. Taking the full UK State Pension of £9628 at 66/67 is equivalent to boosting a retirement portfolio by over £350,000 so the planning process is not a simple matter of aiming to build savings of XX times annual expenses and it is possible that a smaller pension pot than solely based on drawdown percentages will be needed. The big unknown, certainly in the UK is whether early retirees will be able to purchase voluntary Class 2 or 3 contributions as expensively as now in order to receive a 100% State Pension.

For many, it is the FI in FIRE that is the objective. The freedom not to have a life of leisure but the freedom to pursue alternative careers, education, or voluntary activities. To work where and when one wants. Many find alternative sources of income that enable less dependence upon drawing from savings. Certainly, for those retirees (semi-retirees), 25 times expenses may work well but for anyone who doesn`t intend to have supplemental income and who maybe will not have access to social security benefits then aiming for a portfolio of just 25 times future annual expenses is a high-risk strategy.

Hey, Max!

Interesting article, yet I am unfamiliar with the range of fees commonly charged. What is an acceptable fee when going through an IFA / pensions manager (which I do)? And, are there any real options for reducing fees? What impact might these have?

Thanks,

Steve

Hi Steve, less than 1% of funds under management on top of the costs of the funds/ETFs would be a reasonable IFA cost. Doesn’t sound like a lot but if future portfolio growth rates are around 7% then the IFA fee represents nearly 15% of your fund`s potential growth. Unless your finances are very complicated you probably just need an IFA consultation to optimise issues such as tax treatment, life & health insurance, etc., every few years or when your personal circumstances change significantly. Products such as index funds, Vanguards`s LifeStrategy range and target date retirement funds really simplify investment and once you`ve decided upon a strategy the rest is plain sailing. This applies both pre and post-retirement.