Periodic Portfolio Rebalancing

The generally accepted wisdom is that portfolios should be periodically rebalanced to bring each asset class back to its original target percentages. There are three reasons why this is considered important:-

Overcoming Human Instinct to Sell High and Buy Low: private investors are often accused of buying during market bubbles and selling during the crashes – buying high and selling low. Periodic rebalancing forces the investor to behave against his instincts and sell assets when they are rising and buy assets when they are falling.

Truth or Myth – Rebalancing Reduces Portfolio Growth?:

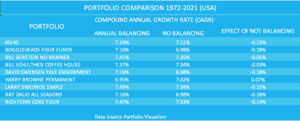

Portfolio Visualizer allows you to simulate portfolios with or without periodic balancing. The table below compares the growth rates with and without annual rebalancing from nine different (USA-based) portfolios. You can see the exact portfolio constituents on the Portfolio Visualizer website.

The results certainly don´t support the “momentum” case against periodic balancing with 8 out of the 9 portfolios producing slightly higher growth when annually rebalanced.

Balancing or Not For The UK? There is a little more evidence that for UK biased portfolios that there is a slight improvement in performance with no rebalancing. Analysing 81 thirty-year investment periods starting in each year from 1910 to 1990 with an initial 60% UK equities (basically FTSE All share) and 40% gilts (duration 15+ years).

54 (81%) of the periods showed improved performance when there was NO rebalancing. Not a great improvement, the average was 0.37%, but over a 30 year investment period, this represents a healthy increase in the portfolio value. The 27 periods that benefited from annual rebalancing showed an average of a 0.4% gain in annualised growth.

Not Rebalancing Creates Risk or Does It? Of course, the consequence of not balancing is that the equity portion of the portfolio will start to dominate and this will produce more risk and more volatility. Of the 81 portfolios, fifty had an equity content of more than 70% at the end of 30 years and thirteen had more than 90%.

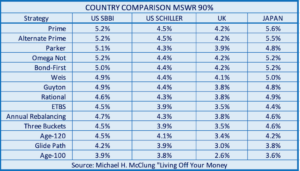

In the next section, I´ll look at alternatives to periodic rebalancing, sometimes called Income Harvesting, some of which have been shown to improve the Safe Withdrawal Rate (SWR) of a portfolio in drawdown despite many of these strategies increasing the equity portion of the portfolio during drawdown which is counter-intuitive to the normal advice of reducing bond holdings with age.

Alternatives to Periodic Rebalancing – Income-Harvesting

- Sell the best performing asset to generate drawdown cash

- Rebalance

Is Portfolio Rebalancing Necessary in Drawdown?

- Withdraw money from either stocks or bonds and then rebalance the portfolio annually to the initial stock/bond proportion. This harvesting rule will be referred to as “Rebalance.”

- Withdraw money from the asset that had the highest return during the year and do not rebalance. This will be referred to as “High First.”

- Withdraw money from the asset that had the lowest return during the year and do not rebalance. This will be referred to as “Low First.”

- Take withdrawals from bonds first and do not rebalance (“Bonds First”).

- Take withdrawals from stocks first and do not rebalance (“Stocks First)”.

“ bonds first, over stocks, the best of all the methods, though the resulting stock-heavy portfolio may make some investors uneasy. This method also is most apt to leave a larger remaining balance at the end of 30 years, while rebalancing leaves the smallest amount.

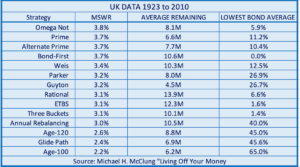

The table below shows the performance of different income-harvesting strategies for the UK market with an SWR based upon 100% success.:-

Here is how Prime Harvesting works:

Example:

Hi Max,

Great post and lots of useful info – many thanks.

I’m a year or so away from drawdown however, trying decide on a realistic, manageable and palatable investement / drawdown strategy is not at all easy! It seems that a UK investors SWR is much lower compared to the US. That coupled with current historically high market valuations (especially US), low bond yields and sustained inflation on its way it feels that sequencing risk ie a major crash in the short term just as retirement drawdown commences is a major consideration. In an attempt to address this posibility I have started looking at Tactical Asset Allocation strategies suitable for a retirement portfolio. From what I have found so far backtested results (US data) produce higher CAGR’s / Sharpe / Sortino much higher SWR’s and for most strategies much lower volatility and capital drawdowns than buy and hold strategies. The downside appears to be potential monthly adjustments to asset allocations depending on the strategy rules. Have you looked into these strategies. (Allocate Smartly has some useful info on TAA). If so it would be good to hear your thoughts.

Thanks again,

Paul

Hi Paul, many thanks for your great comments. I haven´t looked at Tactical Asset Allocation – but I will, and will then comment. You´re right about UK SWR being lower than the US – we have to accept 3% to 3.5% is more realistic than the 4% which has worked well in the US. As you say US valuations are high, UK less so, but having said that the historic and Monte Carlo SWRs should still be valid independent of what part of the cycle you start drawdown. I believe that providing you enter drawdown with a realistic SWR the biggest problem is that you will end up not taking sufficient from your portfolio and when you do realise this you'll probably be too old to appreciate the money available! I think this is where variable drawdown should play a role – ensuring you maximise the drawdown whilst ensuring portfolio survival. I have been simulating various strategies and will be publishing a post in a few weeks. Kind regards Max

Very pleased you like the blog. Having started on Blogger and changed to WordPress I would advise you to start off with WordPress from day 1 but using your own domain name so you´ll probably have to pay for hosting. Before that look at the low-cost courses on blogging that are on udemy.com.