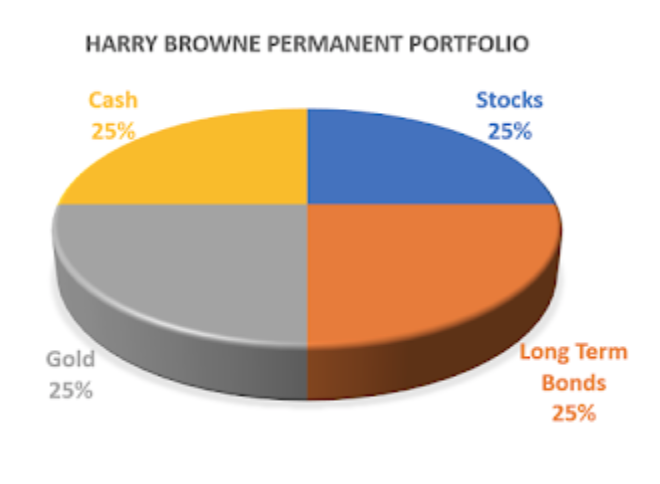

In August/September 2019 I invested £50K to set up a Harry Browne Permanent Portfolio – which has equal parts in cash, equities, gold, and long-term government bonds.

So this is how it has performed:-

|

PERMANENT PORTFOLIO (VALUATION 12/MAR/2020

|

|||||

|

Company

|

Holding

|

Book Cost

|

Valuation

|

+/-

|

+/-

|

|

ISHARES III PLC CORE MSCI WORLD UCITS ETF

|

264

|

£12433.81

|

£10096.68

|

£-2337.13

|

-18.80%

|

|

ISHARES III PLC UK GILTS 05YR UCITS ETF GB

|

93

|

£12463.42

|

£12461.54

|

£-1.88

|

-0.02%

|

|

ISHARES PHYSICAL M ISHS PHYS GOLD ETC USDGBP

|

529

|

£12650.55

|

£13023.98

|

£373.43

|

2.95%

|

|

VANGUARD INV UK LT UK LONG DUR GILT IDX A GBP

|

54.2151

|

£12419.99

|

£13419.20

|

£999.21

|

8.05%

|

|

£49967.77

|

£49,001.40

|

£-966.37

|

-1.93%

|

||

Obviously I would have been better off with an instant access savings account! But I have to be grateful for small mercies that my portfolio suffered a 2% decline compared with around 18% for the FTSE All Share and MSCI Global Indices. Gold and gilts benefited from a flight to safety, cash did nothing and the MSCI Global crashed in line with the market and overall the portfolio proved resistant to the worst maret declines since the 2008 recession.

|

| 6 MONTH PERMANENT PORTFOLIO V FTSE ALL SHARE |

If your objective is just to protect your money from a market crash then stick it in a savings accounts or 2 or 3 year savings bonds and this will certainly protect you more than the Permanent Portfolio but most of us need growth so its illuminating to see if the Permanent Portfolio can provide both protection against market volatility and growth. Below is the simulated 5 year performance of my Permanent Portfolio based upon historic data:-

|

| 5 YEAR PERFORMANCE V FTSE ALL SHARE |

42% growth versus a 9.5% decline from the FTSE is encouraging however it is quite possible that changes to my Permanent Portfolio are imminent as a result on my work on withdrawal portfolio design which I shall be posting on March 21st.