Cash May be King But It Loses Its Value Every Day

Why Hold Cash in an Investment Portfolio

There are many other reasons to keep cash in a portfolio:-

- Dividends Waiting for Reinvestment

- Sale Proceeds Awaiting Reinvestment

- Fear of a Market Crash

- Waiting for Market Bargains

- To even out cash flows in dividend income portfolios

Some investors also keep their “rainy day” cash within their retirement portfolios although I prefer to keep mine separate.

Harry Browne´s Reason for Holding Cash

Harry Browne the creator of the Permanent Portfolio believed that there were 4 market conditions and an asset class appropriate for each condition:-

- Growth – stocks

- Crisis and uncertainty – gold

- Deflation – long dated government bonds

- Tight Money Recession – cash

Browne does highlight the usual benefits of cash – reducing portfolio volatility, having cash available to purchase stocks in market downturns etc. but for him its key role was to support the portfolio in what he described as ¨Tight Money Recession¨. This is when central banks increase interest rates suddenly and significantly to dampen out inflation. This environment is simultaneously bad for stocks, long term bonds and gold. Cash is the only asset class to prosper benefitting from higher short term interest rates which as they are usually above the rate of inflation results in a real rate of return from holding cash – at least in the short run. Tight Money Recessions are normally short lived.

Surely Inflation Linked Gilts Would Respond Similarly to Cash in a Tight Money Recession?

If interest rates are being increased to combat inflation it would be logical to think that prices of index linked gilts should rise or have already risen in anticipation of higher inflation. If this were the case then inflation linked gilts could replace cash in the Permanent and Golden Butterfly Portfolios with the added plus that over the long term the gilts would maintain their real value whilst cash would depreciate.

How Do Inflation Indexed Gilts Work?

In principal inflation linked gilts are a simple concept. They were introduced in 1981 by the then chancellor Geoffrey Howe to meet the needs of insurance companies for investments to match their long term pension and annuity obligations. The American TIPS equivalent were introduced in 1997

and on general are of shorter duration – a typical TIPS ETF has an 8 year duration whereas and index linked gilt ETF has a 20 year duration.

The initial offering by the government of a tranche of index linked gilts is by auction. So a gilt such as the 2 1/2% Index-linked Treasury Stock 2024 has a nominal price of £100 which will be inflation linked and will pay interest at 2 1/2% (£2.50 per £100) which again will be indexed to inflation. The actual initial price paid will be set by market conditions and will certain be much higher than the face value of £100 and after auction the gilt will be traded on the open market. The demand from insurance companies has driven prices high so index gilts are considered by many to be poor investments.

Although simple in concept it is not so easy to assess the prospective yield and return of a specific gilt. The current yield is published assuming an inflation rate of 3%. So the yield on the 2 1/2% 2024 gilt is -2.706% – a nominal yield of 0.294% to redemption. If the inflation rate is lower the yield will reduce. The redemption value in 2024 again depends upon the future inflation rate. The Government Debt Management Office (DMO) has a calculator which forecasts the redemption price based upon different inflation rates. For 2% and 3% inflation rates toe 2024 gilt has forecast prices of £320.65 and £331.79 respectively – compared to a current market price of ££360.23. So today´s purchaser is trading higher interest payments in return for a future capital loss.

What is The Relationship Between Index Linked Gilt Prices and Market Conditions?

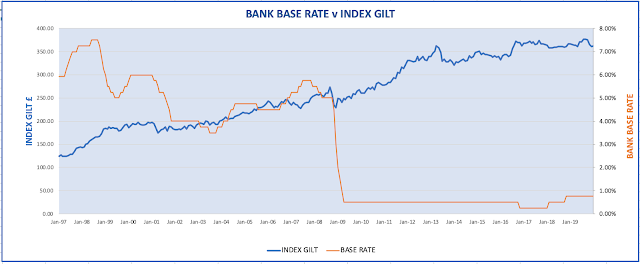

I have looked at the performance of 2 1/2% 2024 indexed gilt from 1997 compared to inflation, bank base rates and the FTSE All Share:-

And the conclusion? I had hoped that that there would be some clearly defined relationship between changes in interest rates and index gilt pricing. What is clearer is that gilt prices are correlated to stock market performance all be it with reduced volatility. Long term index linked prices increase along with RPI but their rate of increase declines during stock market downturns and accelerates with a rising stock market.

The correlation between the FTSE and bank base rates is much more evident:-

Reducing interest rates stimulates the stock market and this does drives up index linked gilt prices so there is indeed a relationship between interest rates and index gilt prices but perhaps weaker than one would expect.

Portfolio Backtest

Unfortunately there are few tools available to analyse portfolios containing index linked gilts. I guess because they are a relatively recent asset class and small in comparison with other assets. So as a second best option I looked at USA based Permanent and Golden Butterfly Portfolios with TIPS as a cash substitute using the PortfolioVisualizer portfolio backtesting tool. A big limitation is that data for TIPs as a relatively new financial instrument (1997) is only available on PortfolioVisualizer from 2001.

Permanent Portfolio:-

The Permanent Portfolio had a Safe Withdrawal Rate (SWR) of 7.94% and a Perpetual Withdrawal Rate (PWR) of 4.78% and the portfolio with TIPS in placer of cash the rates were 8.7% and 5.59% respectively. The TIPS portfolio produced a higher final balance but with greater volatility and a higher drawdown percentage.

Golden Butterfly Portfolio

The Golden Butterfly had a Safe Withdrawal Rate (SWR) of 8.36% and a Perpetual Withdrawal Rate (PWR) of 5.12% and the portfolio with TIPS in placer of cash the rates were 8.98% and 5.78% respectively. Again the TIPS portfolio produced a higher final balance but with greater volatility and a higher drawdown percentage.

So Which is Better – Cash or Index Linked Gilts?

Harry Browne advocated cash as the only asset class to give protection in a Tight Money Recession when interest rates are increased to combat inflation. This was his principal reason for allocating 25% cash in the Permanent Portfolio and it is clear that inflation linked gilts aren´t better than cash in such a situation so if the priority of the investor is to reduce short term portfolio volatility then cash really is king. But if you can accept a slight increase in volatility then index gilts win out medium and long term providing a higher return than cash and still acting as a stabiliser for the portfolio.

A Permanent or Golden Butterfly portfolio with index linked gilts substituted for cash has the potential to provide a retiree with a higher rate of return and a higher safe withdrawal rate with limited downside risk.

Personally I can accept the trade off of a higher return for greater volatility so will be switching my Golden Butterfly cash into the Ishares INXG ETF. However, very conservative retirees in income drawdown will probably be advised to stick to cash or near cash (Ishares IGLS or equivalent) and accept a slightly lower drawdown income in return for a little more peace of mind.