Vanguard LifeStrategy Funds

Vanguard LifeStrategy funds have become a popular option for investors offering a choice of funds with differing risk profiles to suit the needs of investors at various stages of their investment life cycle. A young investor can chooses a fund with a 100% or 80% stock allocations whereas a retiree can opt for a fund with as little as 20% equity holding.

What Are Target Date Funds?

Target Date Retirement Funds increase bond allocation with time to de-risk the portfolio as the investor approaches and enters retirement. They are well established in the USA to the extent that they form the basis of around 50% of all retirement plans. In the UK they are less mainstream but the concept has received more attention of late – all be it negative due to the criticism of the NEST auto enrollment target date fund that it has too high a bond allocation (40%) for younger investors.

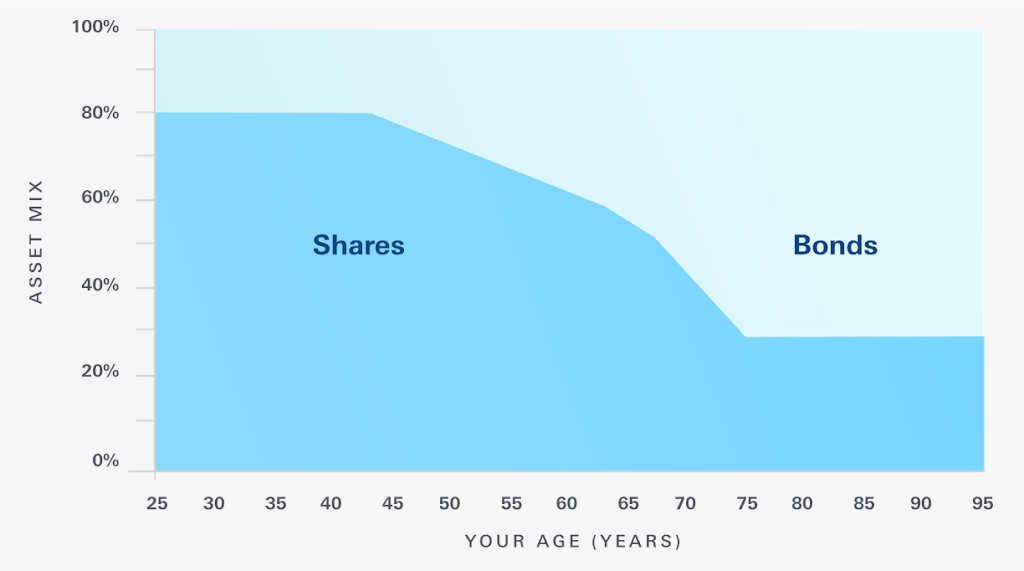

The concept of these funds is simple. As you get older you should be more risk averse and hold more bonds. So these funds are marketed with a range of target retirement years. You pick the Target Date Fund closest to your ideal retirement and the fund will automatically increase the bond holdings as you approach the target date.

When you are several decades away from the target date the fund will have a 80%-100% equity allocation and this gradually reduces as the target date approaches. The equity proportion will continue to reduce for 5-10 years after the target date until it stabilises at 20-30%. In effect it is an automated method of applying one of the bond/equity/age rules of thumb such as the % equity holding should be 100-your age. Vanguard Target Retirement is probably the best known UK range of funds followed by BlackRock Lifepath and Architas Birthstar.

The graph below shows the characteristics of three of the Vanguard Target Date funds – with target dates of 2015, 2020 and 2025. The investor choses his fund on the basis of when he intends to retire but can choose a more conservative portfolio (higher bond allocation) by choosing a target date earlier than his intended retirement year or a more aggressive portfolio be choosing a target date later than his intended retirement year.

So an investor who chooses the 2020 Target Date will have around a 50% stock allocation at age 65 reducing to 30% at age 75. The investor can therefor choose a target date to match his risk tolerance. The table below compares the three different target dates:-

In the case of Vanguard the stock holding reduces to a minimum of 30% but Blackrock and Architas both have lower ultimate stock holdings.

Vanguard Portfolio Characterisitics

The Vanguard LifeStrategy and Target Date funds share many asset allocation characteristics with almost identical equity portfolios and geographic spreads. Their bond allocations are different however with the Target Date fund having a higher weighting to government bonds.

Not unexpectedly the performance of both funds is nearly identical (only 3 years data available for the Target Date fund). Any evaluation of the Vanguard LifeStrategy funds can therefor be applied to the Target Date funds. There is a useful evaluation of the Life Strategy funds on Monevator.

Criticisms of The fund

Hedging: The Sterling hedging of these funds is understandable as they are targeted at UK investors. However, investors who have non sterling expenses through overseas property ownership or lengthy overseas stays would probably welcome some direct exposure to dollar or Euro denominated assets. Hedging has a cost – around 0.2% so there is a price to pay in order to eliminate the effects of currency volatility. Whilst hedging has been unprofitable for UK investors over the last few years and this has adversely affected LifeStrategy performance there is evidence that historically it has been beneficial. The Brandes Institute report “Currency Hedging Programs: A Long-Term Perspective” concluded ” Data covering the full period of floating exchange rates (1973-2006) showed that passive hedging programs have been costly for a U.S.-based investor (-1.8% annualized), but beneficial for an investor based in the United Kingdom (+0.9% annualized), with investors based in the other major currency countries studied seeing less long-term impact over that full period.”

Geographical Allocation: LifeStrategy funds are often criticised for being UK overweight having a near 25% UK allocation compared to the UK´s global stock market share of less than 6%. Personally I think it is a reasonable compromise but there will be many others who view the UK´s prospects negatively and would wish to have a higher overseas participation.

Performance of 2025 Vanguard Target Date FundCompared With a 60/40 ETF Portfolio – Hedged and Unhedged

Certainly over the last 3 years reservations about bond holdings and UK bias haven´t been borne out by under-performance. The issue of hedging depends upon personal circumstances. Probably the majority of investors will be happy not to have to worry about currency volatility on top of market volatility whilst some others would prefer to have some direct overseas currency exposure.

Pre-Retirement – Are Target Date Funds A Good Retirement Savings Option?

Why not? If LifeStrategy funds are a reasonable option for most investors then a Target Date version could be the ideal retirement savings product. Clearly there must be some pretty sound evidence to boost them to such popularity in the USA (not just hefty commissions!). My major concern is over the the glidepath profile:-

- A 20% bond holding for maybe the first 20 to 30 years of savings is probably far too conservative and will depress growth.

- At what age is a 30% equity holding appropriate – if ever? In the era when most retirees had to purchase an annuity a high bond holding close to the target retirement date was sensible. Now a high proportion of retirees are using drawdown over a 30 to 40 year retirement and the only way for that income to last is through a portfolio containing a reasonable proportion of equities. 30% in equities maybe too little at age 75 or 80 when a couple may have to budget for another 20 or 25 years of longevity.

How to Spice Up The Portfolio: Paul Merriman the respected financial advisor is an advocate of a ¨2 Funds for Life¨ portfolio using a Target Date fund and a Small Cap Value fund. This may be a concept worth investigating particularly for younger investors reluctant to have returns dented by a 20% bond holding with the higher volatility and higher potential growth of a sector such as Small Cap value being balanced by the 20% bond holding.

Post Retirement – Target Date Funds in Drawdown

Probably the most important factor when considering a Target Date for retirement income drawdown is the glidepath of the fund – how quickly it reduces its equity holdings. Although choice of the target date of the fund can allow some customising of the glidepath the result in the case of Vanguard is always the same – a 70% bond 30% equity allocation 7 years after the target date. So a retiree choosing a target date to coincide with his 65th birthday will have a 30% equity allocation at 72 years of age. Is this playing it too safe to guarantee potentially 30+ years of income?

The graph below attempts to provide guidance on this. A 40 year retirement is assumed for three investment cases and the maximum annual safe income is shown for bond allocations varying from 0% (100% equity) to 100% (0% equity):-

- A US based retiree with a fund based upon total US stock market and intermediate treasury bonds

- A UK retiree with total UK stock market and 10 year gilts

- A UK retiree with a 25% UK stocks, 44% US stocks, 31% global (ex UK and US) and 10 year gilts

|

| (UK Investor data from Portfolio Charts and US Investor data from Portfolio Visualizer) |

A US Retiree Can Play it Safe With a Higher Bond Allocation

There is a marked difference in the maximum drawdown characteristic. The optimum equity allocation for the US retiree is around 55% but there is only a 0.25% variation in maximum income for equity allocations between 60% and 30%. So the US retiree could have a 30% equity, 70% bond allocation with little sacrifice of income but low volatility due to the high bond content. The Vanguard glidepath would be well suited to him.

The UK Retiree Needs a Higher Equity Allocation

The UK retiree with a 100% UK portfolio has an optimum equity allocation of 65% to 80% and with a diversified geographic portfolio 55% to 90%. In both cases when the equity allocation drops to 30% the maximum income drops by around 10%. At 40% equity allocation income drops by 5% and with 50% income drops by 3%. Surprisingly there is only a 1% difference in maximum drawdown between a 30% equity portfolio and a 40% equity portfolio:-

Summing Up – Target Date or LifeStrategy?

A Target Date Retirement fund such as that from Vanguard is ideally suited to the US retiree but the UK retiree needs a higher equity allocation unless he is prepared to give up income to reduce volatility. LifeStrategy funds would appear to be better options in retirement – a 60/40 equity/bond portfolio is probably optimum for maximum income and a 40/60 portfolio will offer lower volatility at a cost of 5% in income.