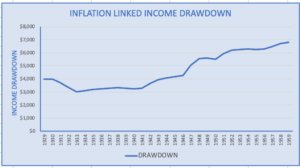

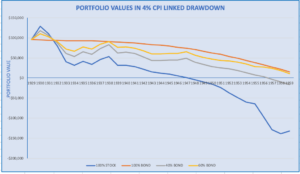

Could your investments survive another 1929 style Wall Street Crash and the subsequent Great Depression? Two out of four of the simple stock/bond sample portfolios looked at in this post would have survived a 30 year retirement at a 4% inflation linked drawdown.

We all hope that lessons from those catastrophic events have been learnt and that interventions from central banks and governments will soften the blow of any future financial shocks and indeed we have seen effective responses to the banking crisis of 2008 and the Covid-19 pandemic of 2020.

However, there must be a risk that should another crisis occur during the next decade that with interest rates at near zero levels and QE still in place (let alone wound down) and with historically high borrowing the central banks not have sufficient ammunition to respond to a severe global financial shock.

Events such as the Wall Street Crash and the great Depression are once in a lifetime financial disasters that we all hope we´ll never experience again. But one never knows and if there are lessons that can be learnt that allow us to engineer our portfolios to survive a similar occurrence then we would be foolish not to learn from history.

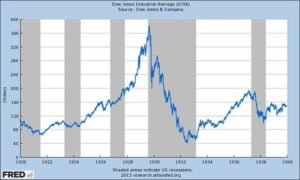

The Wall Street crash started in October 1929 and by 1932 the Dow Jones Index had fallen by 89%.

The impact of the crash was exacerbated by the high level of margin trading which had catastrophic consequences for many investors. The situation was not helped by mutual funds which unlike todays funds often traded at premiums of up to 50% above their net asset value.

Whilst some shares recovered within a few years the Dow index took nearly 25 years to recover to pre-crash levels, albeit with different constituents as companies were relegated, acquired/merged or liquidated. Surviving companies were able to maintain or increase dividends post-crash so for some investors the situation was not as dire as portrayed by the graphic of the Dow performance. In fact in 1930 US companies increased their dividend payouts by more than $2bn.

Causes of the Crash

The Great Depression

Deflation

Interest and Bond Rates

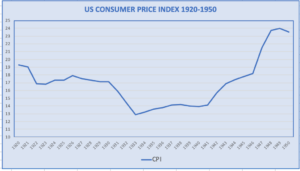

Short term interest rates were increased in 1929 in an attempt to calm the stock market but were sharply reduced post-crash. 10 year bond yields remained over 3% until 1935 and thereafter stabilised at around 2%. With deflation running at 5.7% 10 year treasury bonds were rewarding investors with a real

yield in excess of 7.5%.

Who Were The Winners?

The obvious ones – those who sold out prior to the crash! Story has it that Joseph Kennedy Snr. sold out when his shoeshine boy started giving him stock tips. Having done well in the boom years of the 20s he sold out and subsequently made another fortune when he bought back at market lows. Most weren´t so lucky!

The lucky ones – holders of dividend paying stocks (that didn´t go bust) would have seen there income rise in real terms and with patience capital values restored.

Gold Investors – The US was tied to the gold standard. Gold was fixed at $20.67/oz until 1941 when a price of $35.50 was set. If you held gold in 1929 then due to deflation your real yield would be in excess of 5% followed by a boost of 70+% in 1941 when gold was repriced.

Government Bond Holders – with capital guaranteed and real yields of over 7.5% they were sitting pretty.