Retirement annuity rates have increased significantly with the recent surge in interest rates. Despite this, there is a multitude of reasons why retirees shun annuities. This reluctance is against the advice of retirement academics who see annuities as the optimum way to maximise retirement spending and overcome the frequent reluctance amongst retirees who have conscientiously saved for retirement throughout their working lives to actually spend those savings. Research also shows that retirees who have a high proportion of their income guaranteed through state pensions, defined benefit pensions, and annuities are happier than those whose income is variable.

Of course, many retirees take the decision to sacrifice retirement income in order to leave a greater inheritance for this group annualising 100% of their retirement pot may not be optimum but Partial Annuitisation may be a good compromise

Overcoming the Risk of Buyer Remorse

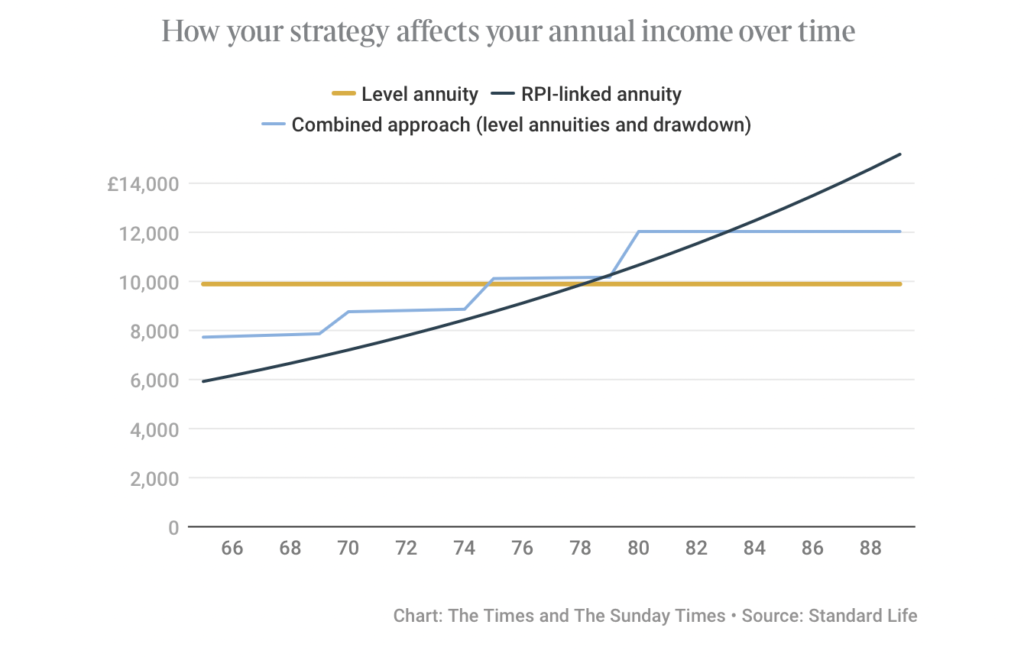

One preoccupation of potential annuity purchasers is the fear of buyer remorse. Future annuity rates may rise, and bad health may reduce the anticipated lifespan of the retiree. One way of reducing these fears is by phasing the annuity purchase so that the annuity rates are averaged out and if personal circumstances change the retiree hasn`t locked in all of his savings. A recent article in the Sunday Times looked at phased purchase comparing three options for purchasing a retirement annuity for a retiree at age 65 with a £150,000 retirement pot. The options were:-

- A level lifetime annuity at age 65 producing a fixed income of £9890 for life

- An RPI-Linked Annuity at age 65 giving an initial inflation-linked income of £5922

- The phased purchase of lifetime level annuities at ages 65, 70, 75, and 80.

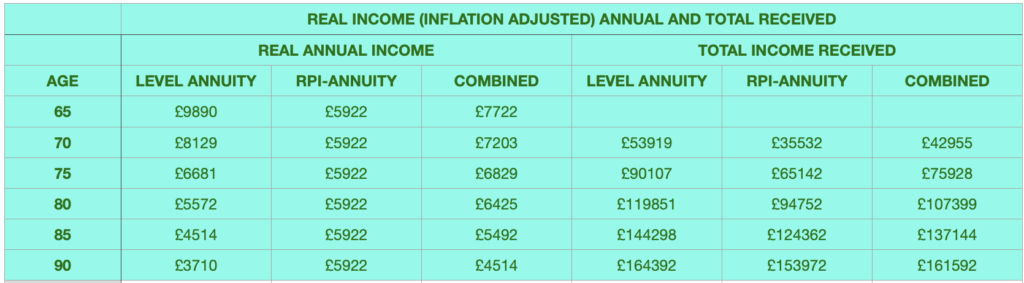

The phased purchase worked as follows with an investment return of 5% assumed for the portfolio left invested and a drawdown income of 3% taken from the remaining portfolio and an assumed 4% RPI.:-

- Age 65 the purchase of a level annuity for £90,000 paying £5,922 with £1800 of drawdown income. A total income of £7722 growing to £7865 after 5 years

- At age 70 the purchase of a level annuity for £20,000 paying an extra £1516. A total income of £8794. (drawdown income is reduced due to the withdrawal of £20,000).

- At age 75 the purchase of another £20,000 level annuity paying £1951 giving a total income of £10,109

- At age 80 the portfolio balance of £26,000 gives an extra £2,644 giving a total income of £12,033

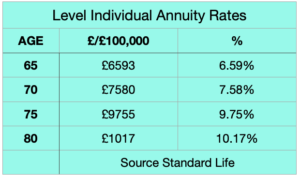

level annuity rates increase with age as shown in the table below:-

(Income is nominal – not adjusted for inflation)

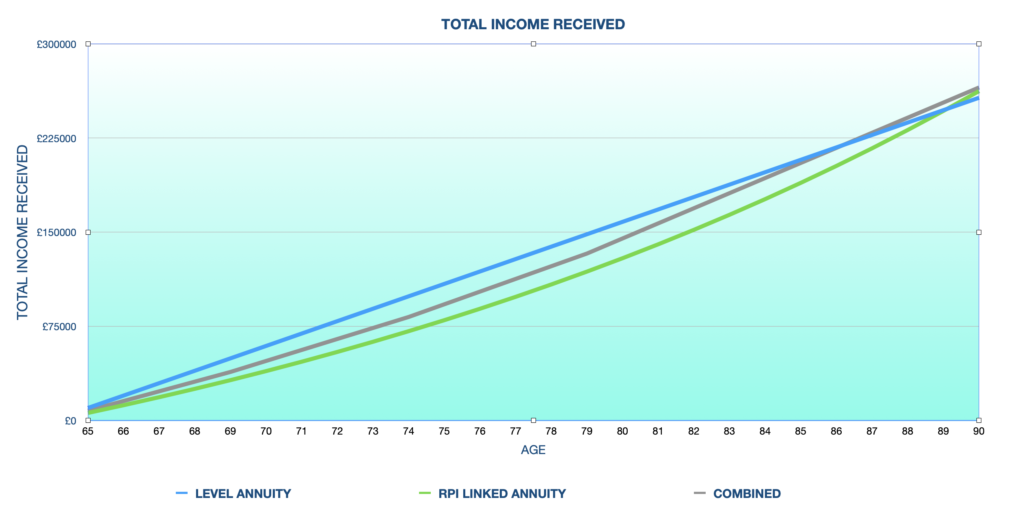

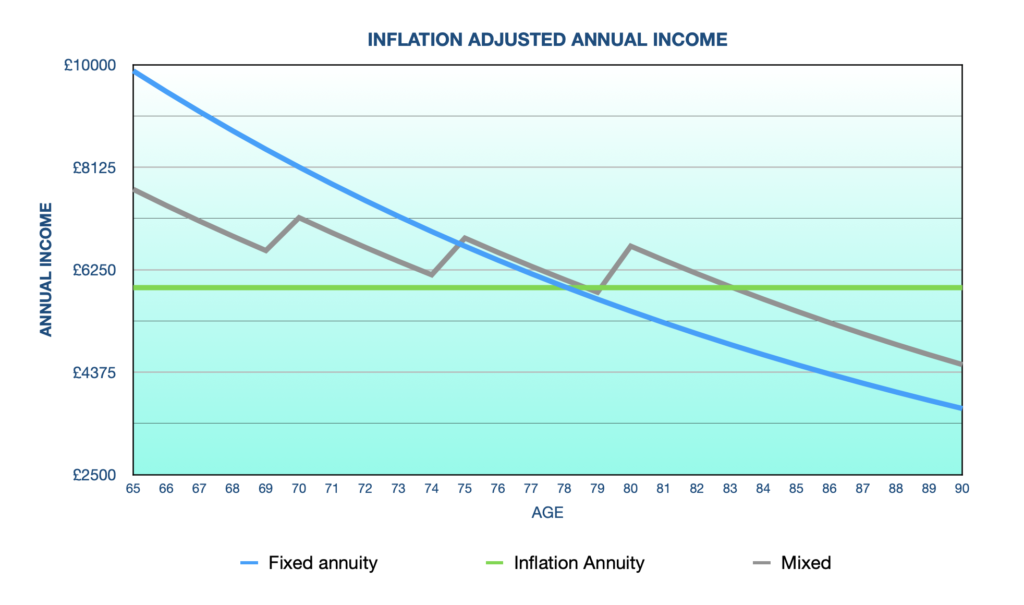

The level annuity provides a higher income for the first 10 years which is then exceeded by the combined approach. The RPI-linked annuity only provides a higher income after age 84. Perhaps what is more relevant is the total income received which is shown in the graph below:-

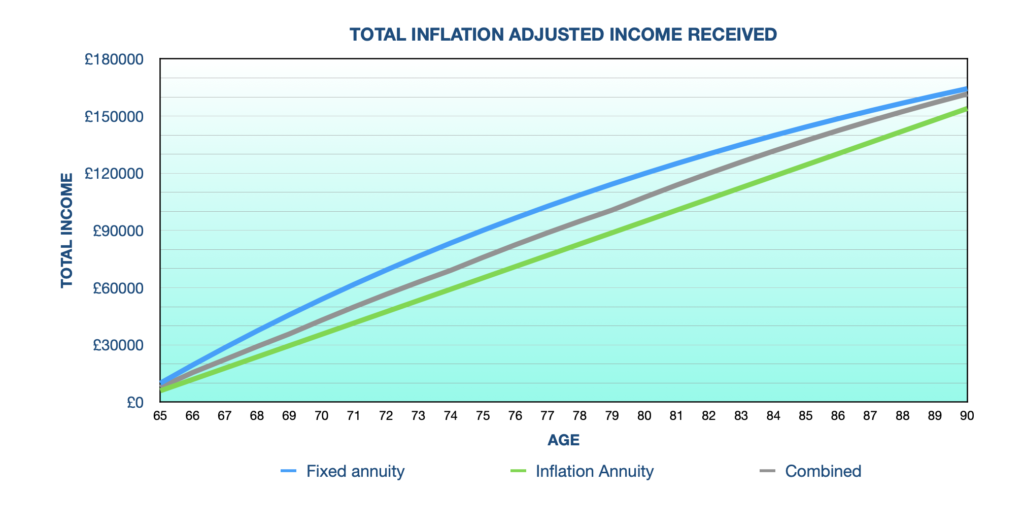

The level annuity produces a higher total income until the retiree reaches age 85 when the combined strategy produces slightly better results. The total income from the RPI-linked annuity lags behind until age 89. The Times calculated the total income received from the three approaches as:-

- Level Annuity £247,250

- RPI-linked Annuity £246,600

- Combined phased annuity purchase £254,090

So the combined approach gives around 3% more total income based on today`s annuity rates. There are disadvantages to this approach in that annuity rates could fall and there is investment risk. However, there is the advantage that the retiree controls some of his capital so if illness strikes he could achieve a higher annuity rate, or in the case of his death there would be some capital left for his heirs.

How Do The Options Compare if Inflation is Taken Into Account?

The Times analysis isn`t taking into consideration the real value of every pound received. Given the choice of receiving a thousand pounds today or a thousand pounds in 25 years time we would all take the money today because, in 25 years’ time, it is going to have far less value in real terms (about £375 at with 4% inflation). So to do an accurate calculation all the income payments must be adjusted for inflation. This results in a very different outcome!

The fixed annuity provides a far higher real level of income during the first decade of retirement and the RPI-linked annuity only outperforms the level annuity at age 79 and the combined approach at age 84. However, when we look at the total real income received the fixed annuity provides the highest total income. It is only towards the end of the 25-year retirement that there is some convergence between the three income strategies. The RPI-linked annuity would start to provide a higher total income at age 91.

CONCLUSIONS

As the table above shows a level annuity provides the highest real income during a 25-year retirement and what is probably of greatest value to a retiree is that the income during the first 15 years of retirement is 12% higher than the phased annuity purchase and 26% higher than an RPI-indexed annuity.

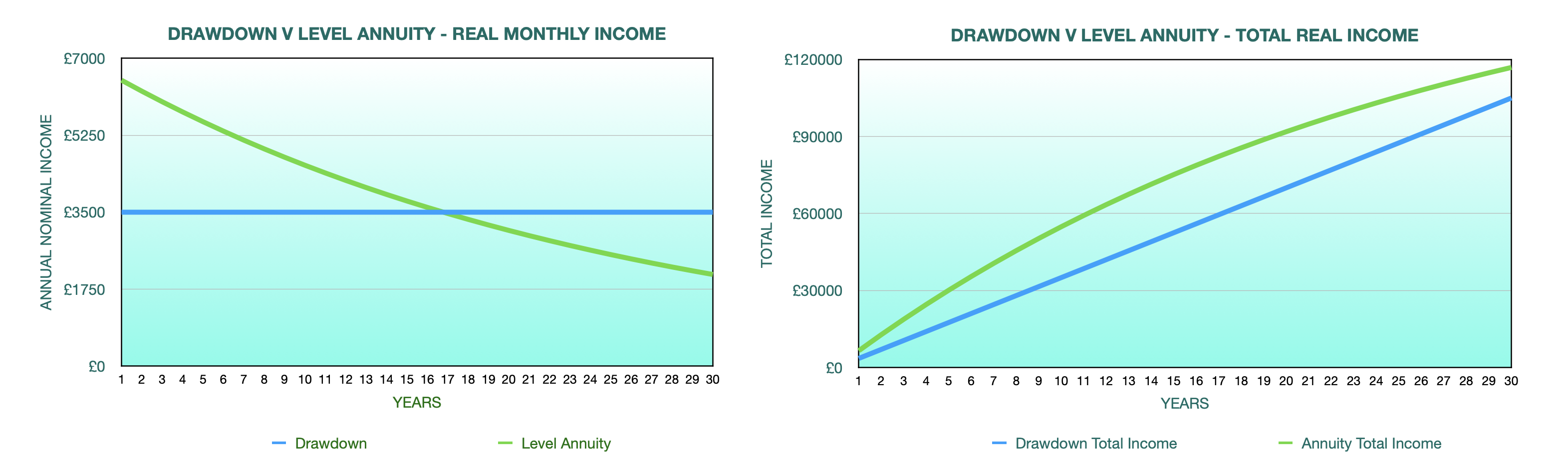

Certainly, for a single retiree, there is now a very strong case now to purchase a level annuity. The 6.5%+ level annuity income at age 65 far exceeds that of income drawdown where 3.5% or less is probably the highest safe initial withdrawal rate. The graphs below show the real (inflation-adjusted) annual and total incomes assuming a 4% inflation rate. It takes 17 years before the annual income from drawdown matches that of the annuity and the total income received from the annuity is never exceeded by the drawdown income.

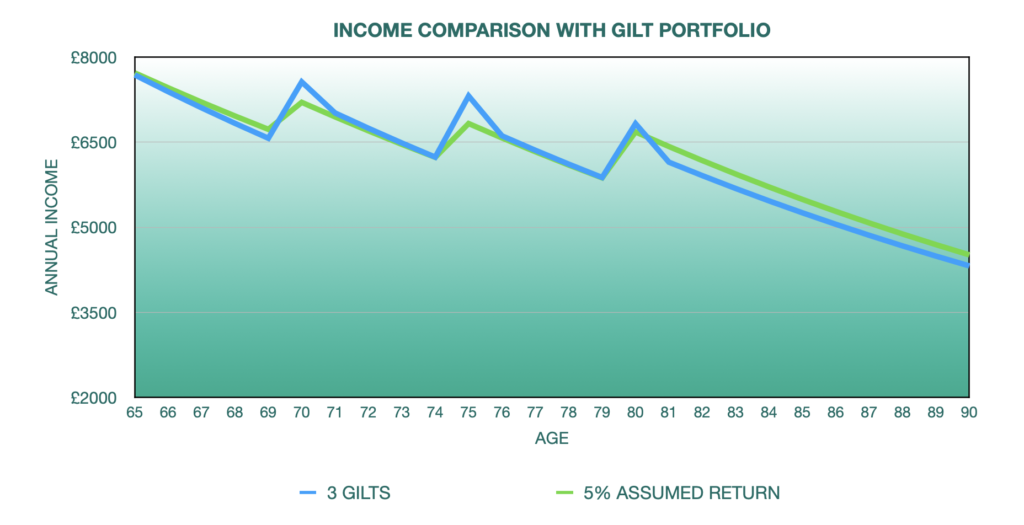

A real risk of phasing annuity purchases is the potential volatility of the portfolio even f only 40% or so is invested in stocks. The safest solution would be to purchase three gilts maturing at 5 years, 10 years, and 15 years respectively.

The 5% assumed yield would be reduced to around 3.25% but the overall impact isn`t significant as shown in the graph below, in fact, an assumed 5% return portfolio only produces a £2000 more total income than using a 100% gilts portfolio. :-

As with most decisions in the world of retirement planning, there is no single solution that`s right for every retiree. Phasing annuity purchases will probably provide greater peace of mind but potentially at a cost of a significant income reduction during the “go go” higher spending years of retirement. My own retirement income approach is to have a diversified portfolio of income sources, State Pension, drawdown, annuities, and an Investment Trust income portfolio. Providing my health holds out I will probably purchase another annuity at age 75. But a large element of my annuity approach is that I am in the fortunate position of not needing the maximum income at this stage of my life. If income were a priority I would have a higher percentage of my income generating funds in level annuities.