Low coupon gilts could be a solution for those investors who have maxed out on their ISAs and tax-free savings interest allowance.

Not so long ago Martin Lewis (MoneySavingExpert) advised listeners to his radio show and podcast that cash ISAs were a waste of time as interest rates were so low at around 1% that you would need around £100k in savings to be at risk of using the £1000 annual interest tax allowance. At the time I felt this was poor advice as it`s always wise to take advantage of any available tax concessions as the future is unpredictable. Now many people will regret taking his advice with interest rates of over 4% on fixed-term cash ISAs and non-ISA savings accounts. So today someone with £25,000 of savings outside an ISA will eat up the annual £1000 allowance (£500 for higher-rate taxpayers). Once ISA allowances are exhausted tax-efficient havens for cash savings are limited. Premium Bonds are one option but some investors have either reached the £50k limit or need a predictable income that Premium Bonds cannot provide.

I am in this situation – not because I followed Martin Lewes`s advice but having lived so many years overseas I have a significant proportion of my investments in General Taxable Accounts (which I am progressively switching into ISAs) but the interest on my bond holdings exceed the annual interest tax allowance so I have been looking for the most tax efficient way to hold cash.

UK Gilts Offer Safety, Predictability (if held to maturity) and are Capital Gains Tax Exempt

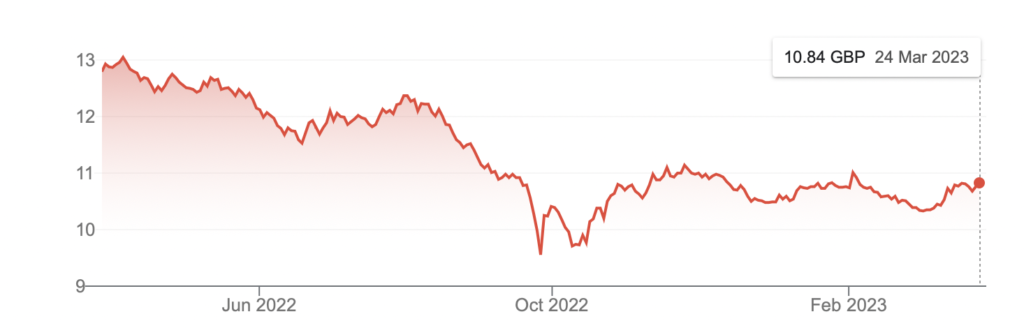

Bonds have performed pretty shockingly over the last 12 months. A key role of bonds within a portfolio is to provide stability by being negatively correlated to stocks. However, as interest rates were raised by Central banks to target inflation bond prices fell tracking the fall in stock prices. The Ishares All Gilt ETF fell by more than 25% at its worst and even after some recovery in gilts prices (a reduction in yields) the ETF is still down by 15% over the last year.

ISHARES IGLT ALL GILTS ETF

This unexpectedly poor performance of the “safe haven” highlights the problems when a bond is not held to redemption. Its market value moves inversely related to interest rates. If rates rise the bond price falls and the longer the duration of the bond the greater the impact of interest rate changes. Bond funds and ETFs have a portfolio of bonds with different maturity dates so they do not offer the certainty that holding an individual bond to maturity gives.

The Ishares All Gilt ETF has an average maturity of nearly 13 years compared to the Ishares 0-5 year Gilt ETF with a 2.45 years maturity. The impact of the longer maturity can be seen in the graph below. The shorter dates ETF fell by around a maximum of 5% compared to over 25% for the longer-dated All Gilt ETF. The additional risk in holding long-dated bonds is supposedly compensated by their higher yields.

The Advantage of Holding a Bond to Maturity

Holding a bond to maturity means you know exactly how much you will receive. A £100 nominal bond will give you £100 on maturity. It’s very unlikely you paid £1000 to purchase the bond because in the case of government bonds when they are issued there is normally some form of auction to determine the sale price. Thereafter the price is subject to market forces and may vary considerably during the life of the bond but the redemption price is set in stone.

Low Coupon Gilts

It`s usual for Gilts to be issued in two varieties; (i) with a low coupon (low-interest rate) and (ii) with a higher coupon. The pricing is such that both will give around the same total return over the life of the gilt. The low coupon gilt is aimed at investors who don’t need the interest payments and prefer to take the return in the form of a capital gain and the higher yielding gilt is for the investor who wants a regular income.

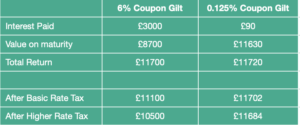

For instance, an investor looking for a 5-year maturity can choose between a gilt with a coupon of 6% maturing in July 2028 or one with a 0.125% coupon maturing in January 2028. The former is priced at around £115 and the latter at £86. The yield to maturity of both of them is around 3.1%. The purchase of the low coupon gilt will on maturity receive £100 for his investment of £86 and the investor in the 6% gilt will receive £15 less than he paid but will have received a far higher level of income.

The gains on Gilts are exempt from capital gains tax (although the interest payments are taxable). Holding a low coupon Gilt in an account that isn`t tax-sheltered (ISA, SIPP, etc.) minimises the tax liability as only the very small interest payments are taxable.

The table below compares the returns for an investment of £10,000 in both Gilts if held in a taxable account. Although the pre-tax returns are similar the low coupon gilt is far more tax efficient by around £6000 for a basic rate taxpayer and over £1000 for a higher rate taxpayer.

A Bond Ladder Is A Useful Tool For providing a Guaranteed Regular income or Managing Interest Rates

A bond ladder is a strategy that involves dividing a portfolio of fixed-income investments into multiple bonds with staggered maturity dates. The concept behind a bond ladder is to reduce the risk of interest rate fluctuations by spreading out the maturity dates of the bonds. Here are some reasons why a bond ladder can be useful:

- Reducing interest rate risk: By spreading out the maturity dates of bonds, a bond ladder can help reduce the impact of interest rate fluctuations on the portfolio. As older bonds in the ladder mature, new bonds can be added at higher interest rates.

- Providing a predictable income stream: A bond ladder can provide a predictable income stream as the bonds mature at different times. This can be useful for investors who rely on income from their investments.

- Diversification: A bond ladder can provide diversification by investing in a range of bonds with different maturities, issuers, and credit ratings.

- Liquidity: A bond ladder can provide liquidity as the bonds mature at different times, which can help investors access cash for expenses or reinvestment.

- Customization: A bond ladder can be customized to meet an investor’s specific goals and risk tolerance. For example, an investor can adjust the ladder’s duration or credit quality to meet their investment objectives.

Overall, a bond ladder can be a useful tool for managing interest rate risk, providing a predictable income stream, diversification, liquidity, and customization.

Two Types of Bond ladders

Rollover

Instead of investing say £100,000 in a bond fund or ETF you buy 10 bonds with maturities of 1 year, 2 years, 3 years ….. When the first bond matures you reinvest the proceeds in a bond that matures in 10 years and every year continues in the same fashion, so you always have 10 bonds in your portfolio with maturities ranging from 1 year to 10 years. Of course, you can choose whatever time period you wish, and any quantity of bonds. This rollover ladder is useful in minimising the risk of changes in interest rates and in providing annual liquidity for instance in case of an emergency.

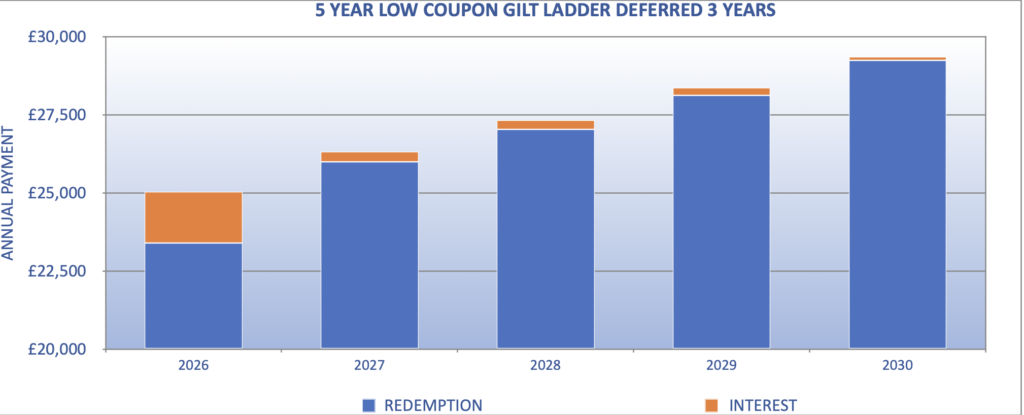

Scheduled Payout Ladder

Example of Conventional Gilt Ladder

CONCLUSIONS

For those investors who have used up their ISAs and tax-free interest allowances low coupon gilts can provide a tax-efficient safe haven for investments. Incorporating gilts into a bond ladder enables either a regular income to be provided or helps reduce interest rate risk.