What Is Portfolio Balancing?

Rebalancing a portfolio is done to realign the asset allocation back to its original target or desired allocation. Over time, the values of different investments in a portfolio may change at different rates, causing the asset allocation to deviate from the intended proportions. By rebalancing, investors aim to manage risk and maintain their desired level of diversification, ensuring that their portfolio remains in line with their investment goals and risk tolerance.

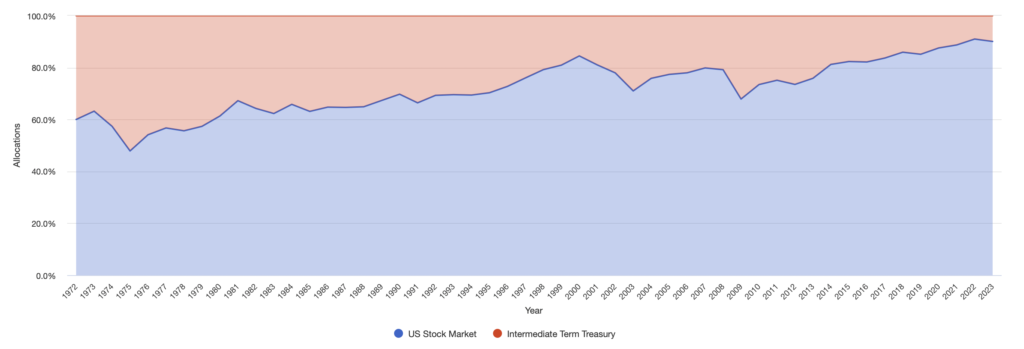

It’s easy to see the consequences of not rebalancing if you look at what happens to the asset allocation of a classic 60/40 equity/bond portfolio when there is no rebalancing. At the end of 30 years, the equities have grown to represent 80% of the portfolio and after 50 years 90%. In fact, for some investors, this increase in the portfolio`s risk and volatility may not be a problem but certainly for a retirement portfolio conventional wisdom is that the older you are the more bonds you should hold, so the idea of holding a portfolio dominated by equities may make some retirees uncomfortable.

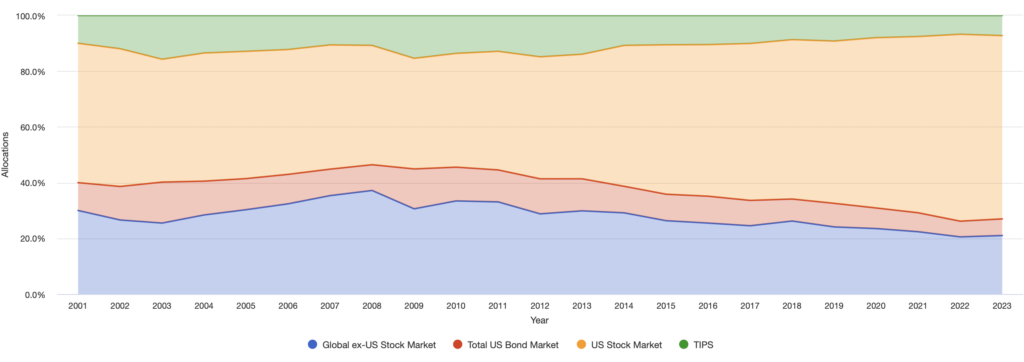

The effect of not rebalancing a more complex portfolio can be seen below. The best-performing asset class will ultimately dominate the portfolio. This may not be the worst outcome but portfolios are the result of extensive research and simulation in order to produce a specific balance between risk (volatility) and growth and periodic rebalancing is assumed.

BOGLEHEADS 4 FUND PORTFOLIO – NO REBALANCING

How Often Should You Rebalance?

The frequency of portfolio rebalancing depends on individual investment goals, risk tolerance, and market conditions. There’s no one-size-fits-all answer, but here are some general guidelines:

- Time-based rebalancing: Some investors choose to rebalance on a fixed schedule, like quarterly, semi-annually, or annually. This approach helps maintain discipline and keeps the portfolio in check over time.

- Percentage-based rebalancing: Another method is to rebalance when the asset allocation deviates from the target by a certain percentage, like 5% or 10%. This approach allows for more flexibility, and you’ll rebalance only when significant deviations occur.

- Combination approach: Some investors use a combination of time-based and percentage-based rebalancing, which provides a balance between discipline and flexibility.

Ultimately, the key is to avoid excessive trading and excessive costs associated with frequent rebalancing. Regularly reviewing your portfolio’s performance and rebalancing when needed can help ensure it stays aligned with your investment objectives.

How Does Rebalancing Influence a Portfolio`s Growth Rate?

Many years ago I remember reading an article promoting the merits of bond/equity portfolios and it was stated that although bonds might have a 4% average return and equities 8% giving a 50/50 portfolio, in theory, an average annual return of 6% but this would be boosted by at least 0.5% due to rebalancing. The argument is that forcing you to buy low and sell high will boost returns and will also overcome an investor`s natural tendency to do the complete opposite.

In fact, portfolio rebalancing can have an impact on its growth rate, but the effect is not straightforward and depends on various factors, including market conditions, the frequency of rebalancing, and the assets’ performance.

- Risk management: Rebalancing helps manage risk by preventing the portfolio from becoming too heavily concentrated in a particular asset class that may be performing exceptionally well at a given time. By periodically selling assets that have outperformed and buying those that have underperformed, you can maintain a more balanced and diversified portfolio, which can help mitigate risk.

- Potential returns: Depending on the market cycle, rebalancing can either enhance or limit potential returns. In bullish markets, frequent rebalancing may reduce the overall growth rate because it involves selling assets that are performing well. On the other hand, during bearish or volatile markets, rebalancing can be beneficial as it allows you to buy assets at lower prices, potentially increasing future returns.

- Discipline and emotional bias: Rebalancing helps investors maintain discipline and avoid making emotional decisions based on short-term market fluctuations. This can lead to better long-term results as it prevents reactionary trading.

- Transaction costs and taxes: Rebalancing may incur transaction costs and tax implications, which could impact the portfolio’s overall growth. Minimizing these costs is essential to ensure that the benefits of rebalancing outweigh the associated expenses.

I`m going to look at two scenarios. One for someone during the accumulation phase and the other for a typical portfolio of a retiree (apologies for making this US based but there are far better US-based portfolio analysis tools available).

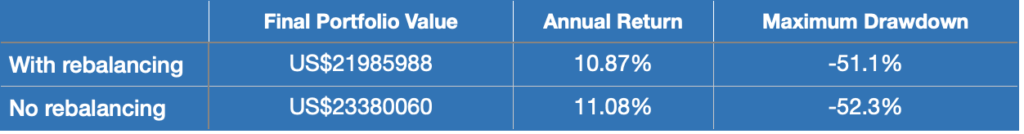

Accumulation Portfolio

Annual contributions of $5000 increased annually by inflation. 1972 to 2023

- 90% Total US stock market

- 10% US Small Cap Value

So with no rebalancing, there is around a 0.2% improvement in growth (giving the investor an extra $1.3M). But this is at the expense of greater volatility and whilst the Small Cap Value asset class has higher long-term growth it is also more volatile so as its share of the portfolio increases (ultimately 33%) it does introduce more risk into the portfolio.

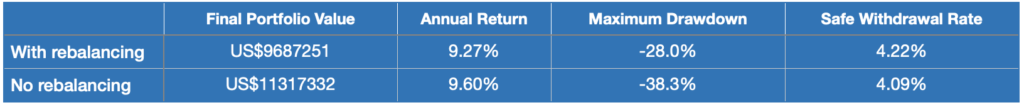

60/40 Retirement Portfolio

Here I`m assuming a $100,000 initial investment with no additional contributions from 1972 to 2023.

- 60% Total US market

- 40% Intermediate Treasuries

There is higher growth without rebalancing at the cost of greater volatility and a lower Safe Withdrawal Rate.

Conclusions

Overall, portfolio rebalancing is a strategic decision that aims to align the portfolio with your long-term investment objectives and risk tolerance. It may not necessarily lead to higher growth rates in all market conditions, but it can provide more stable and predictable performance over time. The specific impact on growth rate varies for each investor and their unique financial situation.

During the accumulation phase with a 100% equity portfolio comprising equities in different sectors, it is a valid option not to rebalance and let the highest growth equity class a free rein. Where portfolio volatility is important then periodic rebalancing is essential even if this results in slightly lower growth.