It´s Pretty Well Impossible to Have a Passive Dividend Income Strategy

You Have to Actively Manage an Investment Trust Income Portfolio

Methodology

I am looking for trusts that:-

-

-

- Pay a dividend yield at least as high as a typical drawdown Safe Withdrawal Rate (SWR)

- Have demonstrated a strong commitment to increasing or at the very least maintaining dividends

- Have beaten the FTSE All Share Total Return over 5 to 10 years

- Pay dividends predominately from revenue, not capital

- Ideally, they should have the equivalent of at least one year of dividends in revenue reserves

-

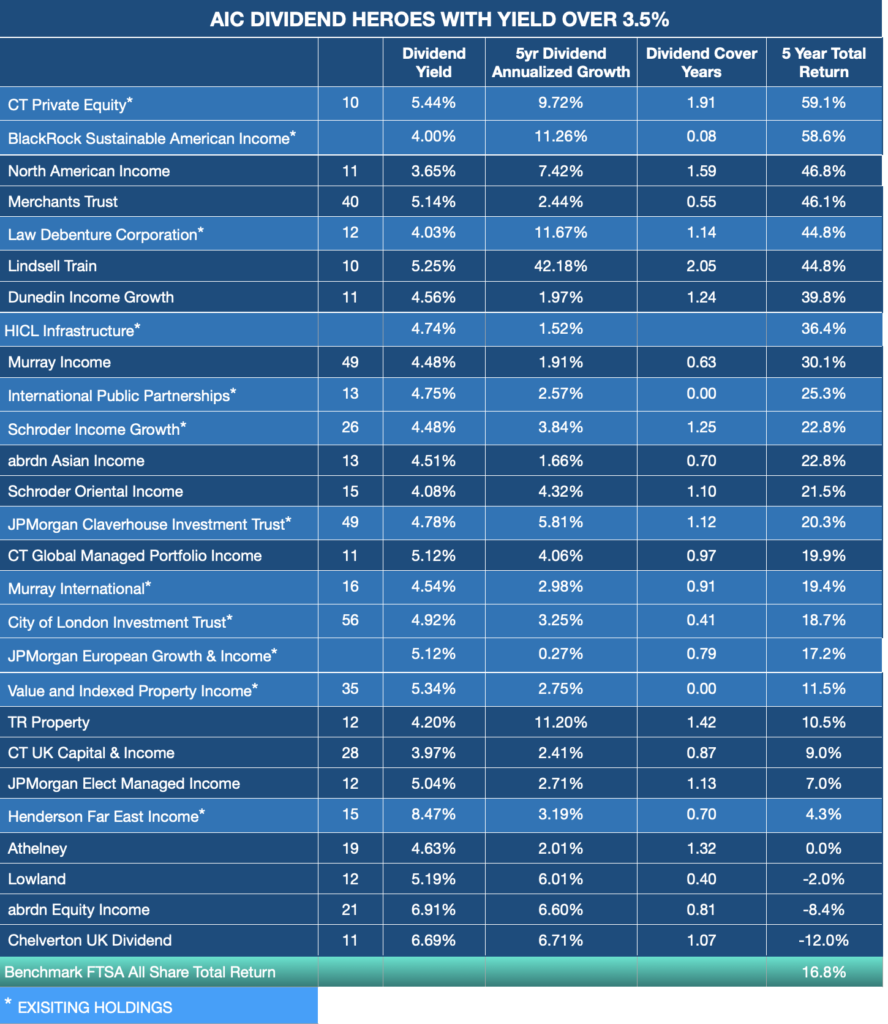

One year plus of dividend cover is currently a rarity as whilst strong market returns had allowed most trusts to build up their reserves post 2018 crash, most had to dip into their reserves in 2020 in order to maintain their dividend payouts when a high proportion of UK companies were forced to cancel their dividends. For instance, the reserves of The City of London Investment Trust which have increased dividends for the last 56 years have fallen to around just 5 months’ cover.

Selection Criteria

-

-

-

-

-

- 5 Year Dividend Growth

- Dividend Cover (years)

- Total Assets

- 5-year Total Return

-

-

-

-

- Minimum Yield 3.5% – roughly the safe withdrawal rate (SWR) of a drawdown portfolio

- Assets > £100m. Small Investment Trusts are vulnerable to mergers and closures and will not attract the best managers.

The Final Cut

My principal aim with this annual review process is to examine the performance of my current holdings to see if they are underperforming their peers or if there are warning signs such as reduced dividend cover that raise a red flag that it is time for action.

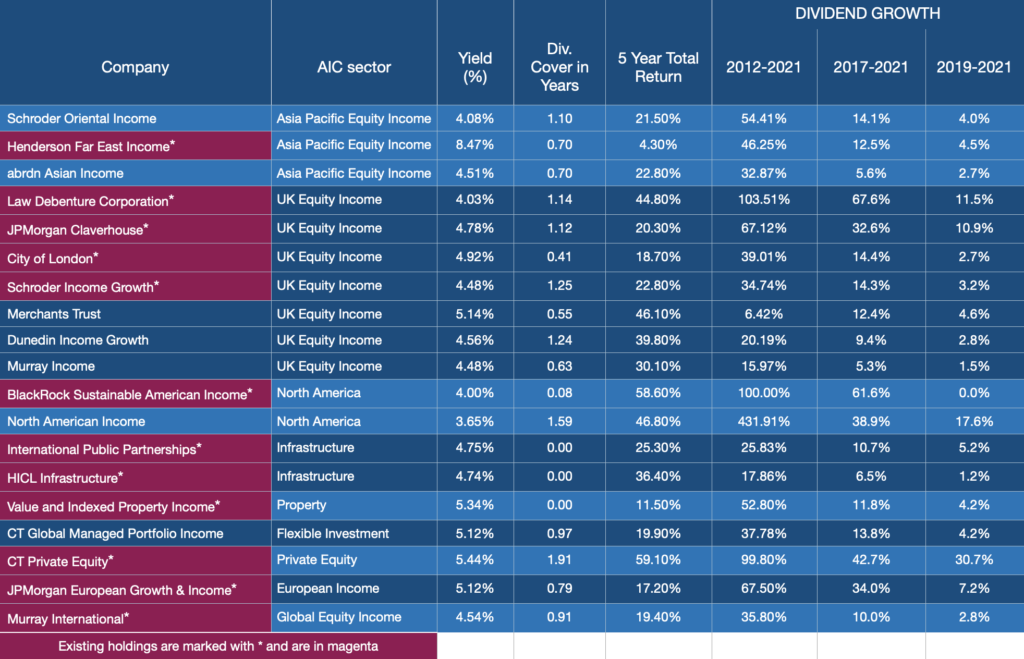

Asia Pacific: Capital Growth or Income? This dilemma is highlighted when you look at the Asia Pacific sector. The dividend yield of Henderson Far East is almost double its competitors at 8.47% yet the dividend growth is also strong compared to trusts in other sectors. But its 5-year total return was only 4.3% compared to the 20%+ of others in its sector. The trust states in its annual report that this poor capital performance is due to its focus on value companies and that the shift from growth to value will improve its share price performance. The good news is that dividends are covered by revenue so there is no reason to think that its payouts are at risk unless there is a change in the trust`s objectives to focus more on total return. So I will be sticking with the trust for the time being.

UK Income: The biggest concern is the low dividend cover of City of London. With 56 years of increasing dividends, it will be reluctant to ditch annual increases. However, the 0.5% 2020 to 2021 dividend increase is probably an indication that the future is like to be miserly dividend uplifts. I am therefore switching my holding to be divided equally between Schroder Income Growth and JPMorgan Claverhouse.

North America. BlackRock’s Sustainable American Income looks very shaky. Dividends have been frozen in Sterling terms since 2018 despite the decline of the Pound which should have boosted dollar-donominated dividend income. Reserves are negligible although dividends are covered by revenue. Accepting a lower yield and swapping into abrdn`s North American Income looks like a better option.

Property. Value and Indexed is transitioning from a 50% property, 50% UK equities to a 100% property trust. The yield at 5.3% and the historic dividend increase rate are healthy but the 5-year performance is poor at 11.5% and well below the sector average of 40%+. I give this trust an amber warning light. It all depends on how their transformation pans out.

Other Sectors. No great worries except last year JPMorgan European merged their capital and income portfolios and now is aiming for a 4% yield on the previous year`s net asset value. If this is strictly followed then any market downtown will result in a dividend cut. Unfortunately, there is no alternative European Income trust so it is likely that at some point I will have to exit the sector by switching into a global trust such as Murray International which is 25% or so in Europe

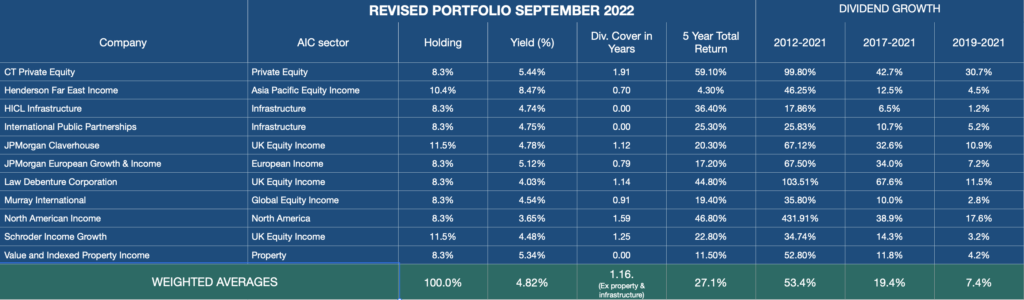

Revised Portfolio

The two changes are switching out of BlackRock Sustainable American Income and City of London. Both moves are due to the weak revenue reserves of both and the likely constraints this will impose upon future dividend growth. This does result in a reduction in portfolio yield from around 5.1% to 4.8% but an increase in dividend cover to a more healthy 1.16. The table below shows the final £240K portfolio and the weighting of each trust:-

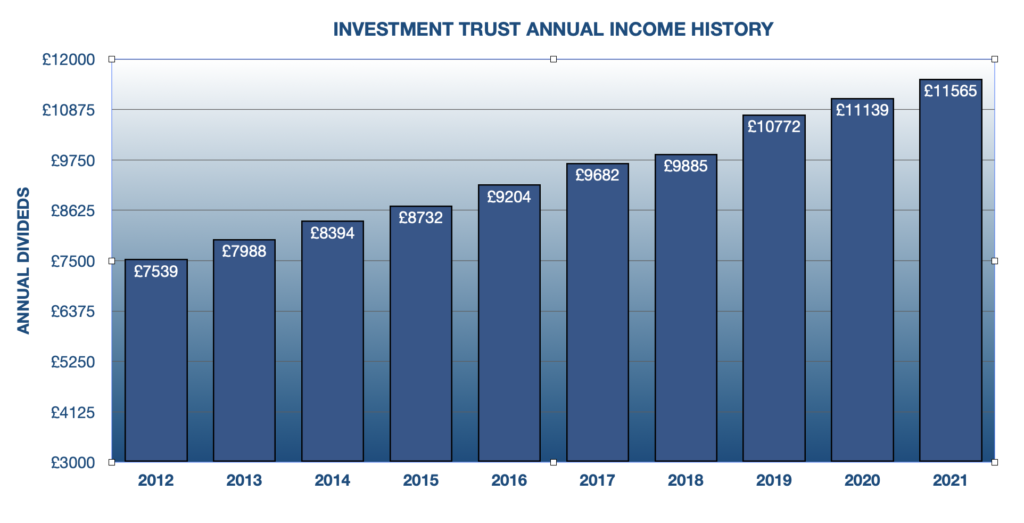

The portfolio has shown an annualised dividend growth rate from 2012 to 2021 of 4.9% compared to a CPI of 2.1% and a total dividend growth of 53% over the same period.

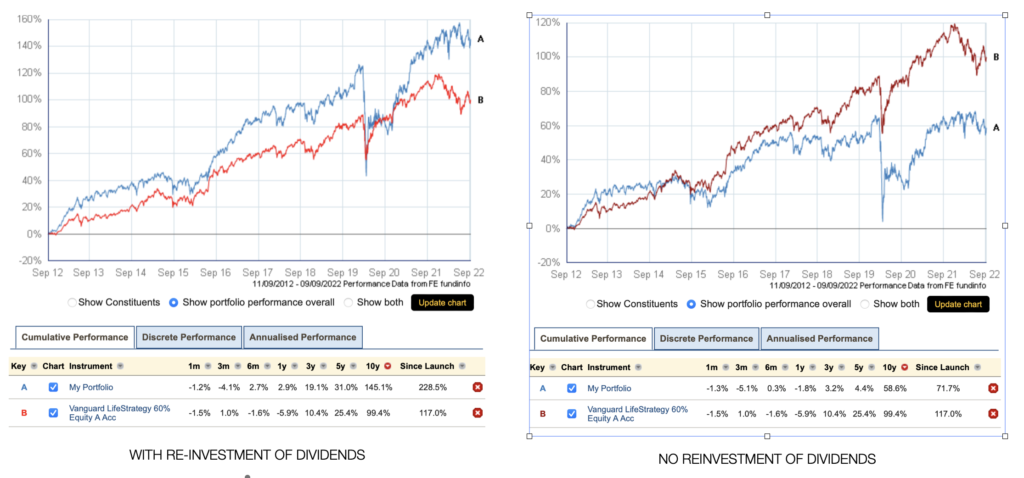

The 10-year performance of the portfolio is shown below compared to Vanguard`s LifeStrategy 60% Equity which I have taken as a comparator as this fund would be popular in pension drawdown. With a reinvestment of dividends the portfolio out-performs LifeStraegy over 10 years by around 50%. Not surprising as it is 100% equity and not surprising also is its far greater volatility experiencing a worst-case fall of nearly 70% compared with about 25% for LifeStrategy.

With no re-investment of dividends which is the situation when relying on dividends for income, the situation is reversed with Vanguard out-performing by 70% over 10 years just confirming that living off dividends is no “free lunch”. Using Investment Trust Income as opposed to total return drawdown means having a very strong stomach to ride out the increased volatility and acknowledging that taking the dividends as income will reduce the capital.

This concludes my annual Investment Trust Income portfolio review. Just two changes in order to boost eliminate those trusts at risk due to poor revenue reserves. JPMorgan European and Value & Indexed are now on the watch list. Overall it has been reassuring how Investment Trusts have weathered the 2020 Covid dividend crisis but it would be foolish to believe that dividends will be able to match the 10% or so inflation levels predicted for the UK. It could well take 5 to 10 years before dividends have fully compensated for the inflation hit.

It’s difficult to know if the total return drawdown retiree would be in a much better position than the dividend income investor. Theoretically, he can increase his drawdown income in line with inflation which puts him in a far better position than the dividend investor (in the current environment). However, I suspect that most drawdown retirees will take a far more conservative approach given the highly unfavorable combination of high inflation and declining stock markets. Certainly, in the case of my drawdown portfolio where I use a Variable Drawdown strategy, it is probable that if I follow the rules I won`t be able to take any income increase next year unless markets improve.