VALUE & INCOME INVESTMENT TRUST |

Value and Income (VIN) is an income investment trust that I have held on and off for over 20 years. It is an unusual in that it combines an equity income portfolio (around 60%) with a physical property portfolio (around 35%). There is some logic to this approach – reliable income from commercial property with greater growth potential and diversification from the equity holdings.

VIN was amongst the 40+ income ITs that I analysed for inclusion in my 8 IT Retirement Income Portfolio but it failed to pass muster in terms of post 2007 dividend growth and share price performance.

However I still have a small holding (<£5k) in an ISA and must decide what to do with it knowing that it has not fulfilled my income portfolio criteria and unwilling to sell during the current market downturn and tempted by its current 7%+ yield yet knowing that historically it may not be a super performer.

Up until the end of Jan 2020 it was the worst performer in my IT income portfolio but looked at in isolation its performance doesn´t look too bad:-

Dividend Cover 0.7years

Areas for Concern

Gearing: the level of gearing is typical for a property fund but as VIN´s property portfolio only represents 35% of the total holdings the level of gearing must be considered as high.

Property Portfolio Sector Weighting: Had we known about the implications of Covid-19 back in January the 45% property portfolio allocation to pubs/restaurants/leisure would have got the warning lights flashing

|

Property Portfolio Allocation by Sector |

Post 2007 Performance

|

VIN DIVIDEND PER SHARE 2007 TO 2019 |

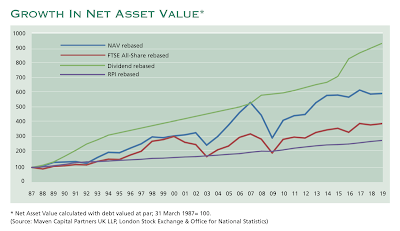

The performance of VIN was commendable. Dividends were increased from 2007-2012 at a compound rate of 3.7% and from 2007 to 2019 at a rate of 4.8% – both comfortably ahead of inflation.

The share price for January 2008 to January 2020 was up 51.7% compared to 34.8% from the FTSE AllShare.

|

Long Term NAV and Dividend Performance |

Covid-19 Crash Performance

VIN has stabilised after the Covid-19 crash at about 29% down from its January level. This compares to a 20% fall in the value of the Retirement IT Income Portfolio.

|

Value and Income Trust v the Retirement IT Income Portfolio |

|

VIN SHARE PRICE v FTSE ALL SHARE JAN-APR 2020 |

With the decline NAV gearing has increased to 41% and after an initial widening of the discount to NAV it currently sits at around 15%. The big concern must be over the property portfolio which is far from ideally positioned with the current Covid lockdown. The portfolio manager made the following comments in her most recent report:-

¨Due to a strategic sales program over the last 10 years the Fund is now no longer invested in high street shops or retail warehouses. Despite the impact of the Covid-19 pandemic and the forced closures of the pubs & leisure sectors on 20 March 2020, 89% of the March quarterly rents (as at 14 April 2020) have been collected or a payment plan agreed.¨

Conclusions

The long term performance of Value and Income has been quite acceptable with above inflation dividend growth, an attractive yield and a share price that out performed the FTSE All Share. However, in my analysis of Income Trusts for the Retirement IT Income portfolio better candidates emerged. I have also learnt to be mistrustful of property investments as they never seem to offer the promised diversification and there are few signs of stabilisation of the UK property market.

Post Covid-19 crash Value and Income faces not only the same dividend challenges as other income trusts but has to contend with a property portfolio that is weighted towards the hardest hit sector – leisure. The short term outlook is therefor uncertain although it has the revenue reserves to sustain the dividend, at least over the next 12 months

If I were investing from scratch I would not have VIN on my short list. As an existing holder at some more opportune time I will sell when market conditions are more settled.