I certainly hadn’t been planning on revisiting Safe Withdrawal Rates and William Bengen’s 4% Rule. But two recent podcasts which had very click-bait style headings stimulated my interest and as I delved a bit deeper I found some interesting updates on Safe Withdrawal Rates and Variable Withdrawal methods. I’m summarizing these in this post but for anyone with the time they are well worth looking at in more depth. As ever the best research is aimed at the US retiree but most of the information is applicable to the non-US investor providing that it is recognized that safe withdrawal rates have to be reduced due to inflation, currency and fee variations – even if identical investments are used. So I`ll be covering the following topics:-

-

-

-

- The Dave Ramsey 10% Withdrawal Rate

- The 2.26% Safe Withdrawal Rate for US Retirees

- The 2.26% SWR Updated for Overseas Investment

- Wade Pfau`s Safe Withdrawal rates For Non-US Retirees

- Morningstar`s 2022 Report on Retirement Income

- A Recommendation for a Podcast/YouTube Compendium of Interviews with Leaders in Retirement Finance on SWRs and variable Withdrawal Strategies

-

-

1. The Dave Ramsey 10% Withdrawal Rate

I first saw this on Rob Berger`s financial podcast “The Rob Berger Show” episode 84 headlined “The Dave Ramsey 10% Withdrawal Rate”. Dave Ramsey is a well-known US personal finance commentator and author so it was strange to see such an unbelievable withdrawal rate attributed to him. But yes apparently this derived from phone-in advice given to a couple in their 70s and was based upon the idea of a 100% US stock portfolio returning 12% per annum and with 2% inflation so 10% could be safely withdrawn every year and increased annually by the rate of inflation.

Rob Berger shot this down firstly by pointing out that the compound average growth rate of the US stock market since the beginning of the 20th century has been around 10% not over 12%. Of course, the idea that even at a 10% growth rate you could plan on withdrawing an inflation-linked initial 8% is fatuous as it ignores market volatility and sequence of return risk. If you pop the numbers into Portfolio Visualizer and do a Monte Carlo simulation a 100% US stock market portfolio allows a 4% withdrawal rate for a 90% success rate and a 2.4% perpetual withdrawal rate – these numbers ignore fund and platform fees.

Sometimes untruths make pretty good clickbait!

2. The 2.26% Safe Withdrawal Rate

This was discussed on The Rational Reminder Podcast. and related to a paper published in September 2022 “The Safe Withdrawal Rate: Evidence from a Broad Sample of Developed Markets” by Aizhan Anarkulova, Scott Cederburg, Michael S. O’Doherty and Richard Sias (for brevity I`ll call this the “2%” Report”. The authors are critical of Bengen`s 4% Rule due to the unreliability of historical data which they view as being plagued by “survivorship and availability” bias. The authors are not alone in doubting the 4% Rule as many academics are unhappy about drawing conclusions from a set of US data that comprises only three independent 30-year periods.

To overcome these deficiencies the authors say:-

“We address these concerns using a comprehensive new dataset of real returns for domestic equity, international equity, government bonds, and government bills in developed economies. The data cover approximately 2,500 years of asset-class returns in 38 developed countries over the period from 1890 to 2019.”

The authors take the example of a couple at age 65 retiring in 2022 with a 60/40 domestic US stock/bond portfolio and use published longevity statistics to determine the retirement length for the last survivor of the relationship. Results using this “unbiased” data set show the 4% Rule with US stocks has a 17.4% failure rate and even at Morningstar`s 3.3% withdrawal rate in their paper “The State of Retirement Income” the failure rate is 11.1%. The safe withdrawal rate for a 95% success rate is shown to be 2.26%. Different bond/equity mixes were evaluated but none improved upon the classic 60/40 equity/bond portfolio.

The authors also applied their analytical methodology to a conventional US market data set which as expected produced a far higher safe withdrawal rate of 3.5%.

The authors concluded:-

“Under the prevailing 4% rule, our estimates suggest that generations of retirees jointly face great risk of financial ruin.”

It is difficult to envisage that a safe withdrawal rate could be as low as 2.2% because even if a fund grew by only 1.5% per annum a 2.2% withdrawal rate increasing by 3% p.a. would not exhaust the portfolio for more than 35 years. However, unlikely though is such dire market performance retirees need to be aware that sustained periods of negative market performance have occurred in some markets in the past and the fact that the US stock market has proved very robust over the last century weathering the Second World War, the Korean, Vietnamese, Iraq and Afghanistan Wars, the 2008 Financial Crisis, and Covid is no guarantee of similar future performance. The authors of the paper give the example of Japan whose stock market suffered a nominal (real) return of −9% (−21%) over the recent 30-year period from 1990 to 2019.

An Update to The 2% Report

The 2.26% Report only looked at the performance of US investments for a US retiree. The podcast Rational Reminder asked the authors of the report if they had any data on the effect of overseas investments on Safe Withdrawal Rates. One of the authors, Scott Cederburg, ran some simulations using their overseas data and this is reviewed in the latest show episode.

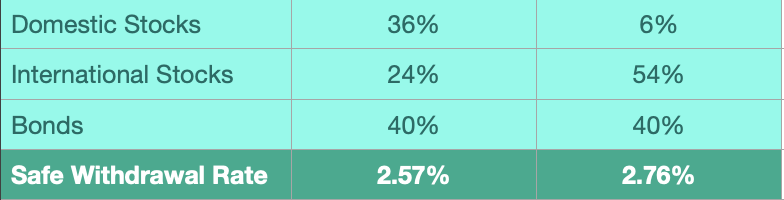

Two variations of 60/40 portfolios were simulated. One is domestically biased and the other is heavily internationally weighted. The SWR was calculated based on a 2085 retirement date and assuming costs of 0.5% for the international stocks. The benefit of international diversification is clear with an improvement in SWR that increases with more international content:-

This improvement in SWR goes against today`s experience where US investors experience a reduction in growth rates with international diversification. However, this does support the report authors` contention that standard historic data sets exaggerate US market performance and that the reported US market performance exceeds that predicted by theory. So the authors` data for future performance shows an improvement in international performance compared to that from the US so the recommendation for the US investor is to have greater international diversification in his portfolio to optimise the SWR. But even with this the 4% Rule cannot be relied upon.

3. What About The International Retiree?

The 2% Report looks at a US retiree, as is the case with so much academic research! There is far less academic analysis on the UK or non-US investors, particularly those who favour an internationally diversified portfolio rather than the domestically biased ones that were more popular 30 years ago. Unfortunately, there is often the assumption that the UK retiree can emulate US retiree performance by adopting an identical portfolio. This just doesn`t work due to the difference in inflation and exchange rates. Increased fund and platform fees compared to the highly competitive US market must also be taken into consideration.

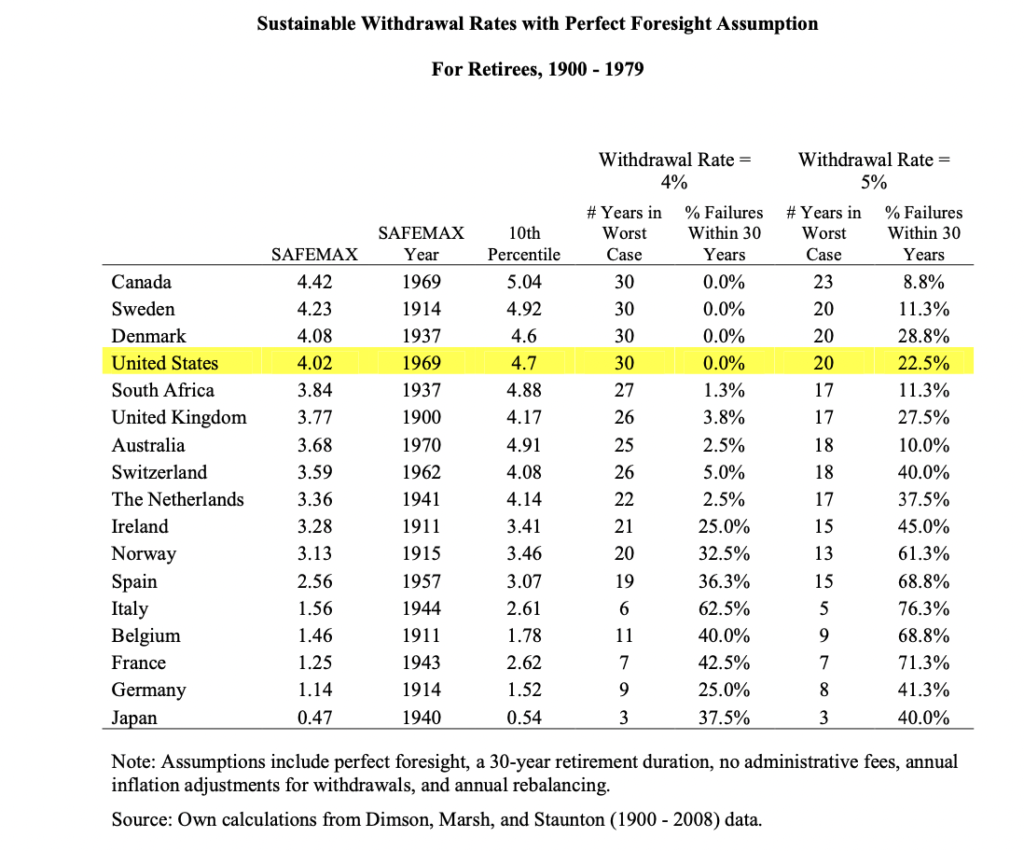

The work of Prof. Wade Pfau is very helpful in assessing differences in the performance of the international investor compared to that from the US. His first definitive study comparing international safe withdrawal rates was published in 2010, “An International Perspective on Safe Withdrawal Rates from Retirement Savings: The Demise of the 4 Percent Rule?”

He looked at 30 developed countries and simulated domestically invested portfolios (assuming no fees) with an optimised equity/bond portfolio – that is he used hindsight to select the equity/bond percentage that produced the best results for each country. Only four countries, the USA, Canada, Denmark, and Sweden sustained a 4% withdrawal rate for 30 years. Others were far less successful such as 7 years for France and only 3 for Japan!

This study when published was a shock for many non-US retirees especially if they were predominately invested in their local stock market, as was very common 30 or 40 years back. It must also be borne in mind that Pfau`s calculations are based on a best-case with-hindsight equity/bond ratio and ignore fund and platform charges.

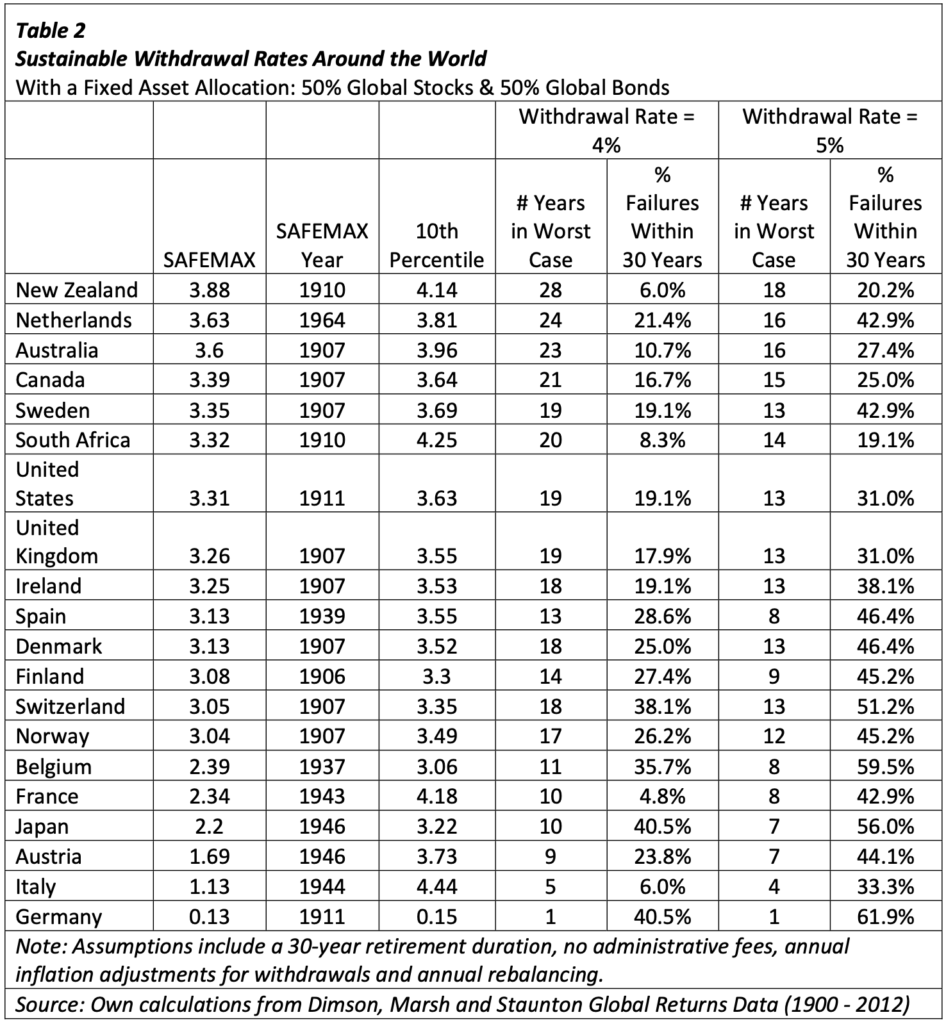

In 2014 Pfau published an updated study, “Does International Diversification Improve Safe Withdrawal Rates?” which is of greater interest to today`s investors as it examines the performance of funds invested 50% in international equities and 50% in international bonds and compares this to a 50/50 domestic portfolio.

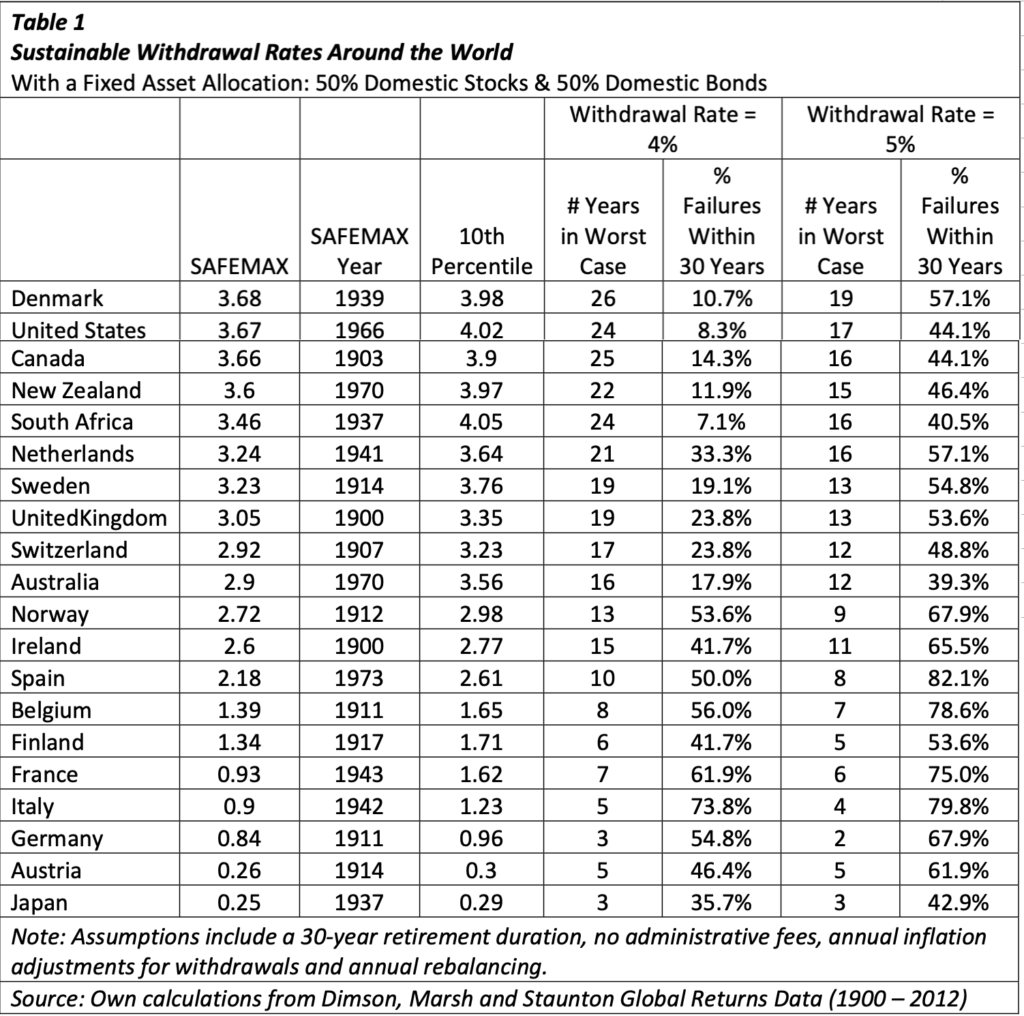

The results for 100% domestic investment are shown below:-

The results for a 50/50 international portfolio are shown below and it should be noted that a 4% withdrawal rate was unable to guarantee a 30-year retirement in all cases. The UK and UK both had a worst-case survival duration of 19 years at a 4% withdrawal rate. The UK SAFEMAX withdrawal rate (where all 30 year retirement periods were successful) was 3.26% or around 3% is expenses of 0.5% are assumed.

In the majority of cases, an international portfolio outperformed a domestic portfolio as shown in the table below:-

Conclusion –The 4% Rule Doesn’t Work in the vast majority of countries. The original study for Pfau showed that the 4% Rule just worked for a US retiree with a 100% US portfolio – but only by excluding fees and with an optimised equity/bond ratio. The 2014 study with international 50/50 portfolios is even bleaker with no country sustaining a 4% withdrawal rate. Pfau doesn`t provide an explanation of the exceptionally poor performance of countries such as Italy and Germany, one can only assume that it is related to currency and inflations effects.

4. Morningstar`s 2022 Report on Retirement Income

Morningstar`s 2021 report “The State of Retirement Income” hit the financial headlines by recommending that new US retirees should only assume a 3.3% withdrawal rate if they wanted a 90% chance of their portfolios lasting 30 years. Unlike the majority of similar studies which used historical data Morningstar used predictions from their analyst teams of future investment returns and inflation rates to estimate the SWR. This report was much criticised by some well-known retirement finance “gurus”. Michael Kitces is his review of the paper stated:-

“Ultimately, however, Morningstar’s conservative return assumptions –

which are comparable to some of the worst periods in the past 140 years –

actually serve to highlight the strength of the 4% rule, which was created to withstand just those types of worst-case scenarios.”

So how would the 2021 retiree have fared if he had stuck to the 4% Rule?. The answer is not very well! 2021/2 was a tsunami of bad news for investors with a rare combination of falling stock prices, falling bond prices, and high inflation.

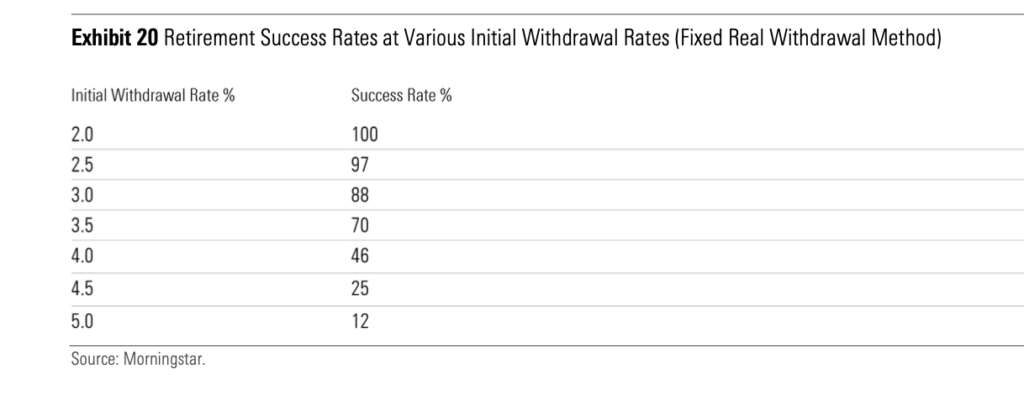

In Morningstar`s 2022 State of Retirement Income report, they estimate the success rates of the 2021 retiree with different initial withdrawal rates:-

Had the retiree followed the 4% Rule his portfolio would have had less than a 50% chance of lasting 30 years. Even at Morningstar’s recommended SWR of 3.3% he would have had less than an 80% chance of not running out of money. The combination of a high rate of inflation which if the 4% Rule is religiously followed drives up cash withdrawal, combined with a sharp fall in portfolio value is the classic worst-case sequence of return risk. In Morningstar’s most recent podcast they propose actions that a retiree in this situation should take.

The other side of the coin with the poor recent market performance is that Morningstar has estimated a 3.8% safe withdrawal rate for the 2022 retiree, up from the 3.3% of last year. This is simply explained by the greater potential for markets to rise after a period of decline combined with the likelihood of declining inflation so projected bond and equity returns are leading to a higher SWR. This is just a reminder that retiring in periods of booming markets is riskier than retiring when markets are down. However, it’s not much consolation if your portfolio is down by 20% and your SWR is up by only 15%!

Morningstar Recommends a Dynamic Withdrawal Strategy

In their 2022 report Morningstar dedicate a large part of their study to looking at Dynamic (variable) Withdrawal strategies. These aim to address the drawbacks of the Bengen-style fixed real income withdrawal strategy (where withdrawal is inflation-linked). These disadvantages are principally:-

- There is no relationship between portfolio performance and the income taken from the portfolio.

- The majority of retirees will never withdraw the maximum income that a portfolio is capable of providing so leaving behind a significant portfolio balance for heirs whereas the retiree may have appreciated a higher income.

- Retirees`spending characteristics are not fixed in real terms. Typically a retiree spends more in earlier years when he enjoys good health, less during the middle part of retirement and his spending in the latter years is health and health system dependent. in some countries with free or subsidised social provision his spending will just gradually decline in later years but in those countries where there is limited social provision his spending will increase (the smiley face profile of spending).

These dynamic strategies aim to link drawdown income to the portfolio performance so retirees can benefit from a higher income during sustained good market performance but with curtailed income growth (or even a reduction) during difficult years to ensure the portfolio outlives the retiree. Of course, there is no free lunch with any of the variable drawdown strategies. A higher income results in a lower final portfolio value for the heirs and the strategies that provide the greatest potential for an increased income usually provide an unstable income level. I look at some of the strategies in my post on Variable Drawdown and chose a simple ratchet-style approach for my own drawdown portfolio that provides a high initial income which only increases if the portfolio maintains its value combined with an optional bonus that is available during excellent market performance.

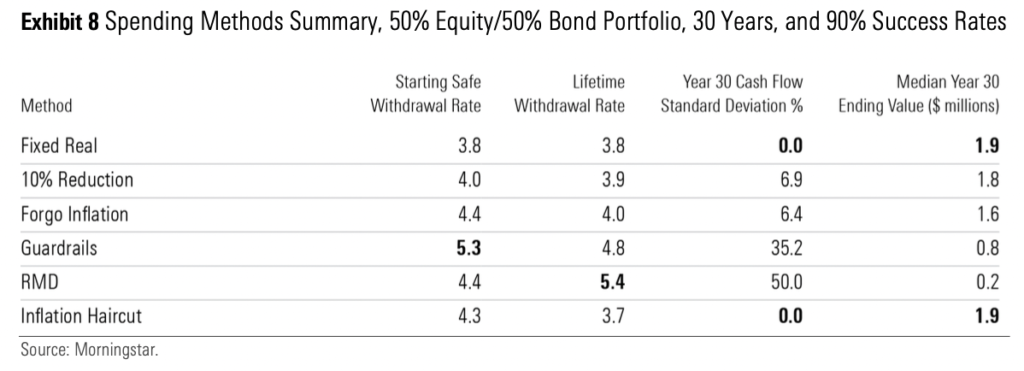

Morningstar examines 5 Dynamic Withdrawal strategies which are compared with Bengen`s Fixed Real (inflation-adjusted) withdrawals:-

10% Reduction. This method uses a fixed real withdrawal system as its baseline but adjusts withdrawals downward by 10% in the year following a year in which the portfolio has declined in value. Once the portfolio generates a positive annual return again, withdrawals resume their previously scheduled amounts.

Forgo Inflation. This is a fixed real withdrawal strategy but with a twist. Whereas the standard 4%-style guideline entails annual adjustments (usually upward) to reflect inflation, this method involves forgoing those upward adjustments following years in which the portfolio has declined in value.

Guardrails. This method, developed by financial planner Jonathan Guyton and computer scientist William Klinger, aims to incorporate some variability based on market performance but sets an upper boundary on how much comes out in good markets and a lower boundary around withdrawals in down markets. The method is more comprehensive and complex than the other methods and is best explained through reference to Guyton and Kinger`s paper “Decision Rules and Portfolio Management for Retirees: Is the ‘Safe’ Initial Withdrawal Rate Too Safe?”.

RMD (Required Minimum Distributions). This is familiar to US retirees and is the the same framework that underpins required minimum distributions from tax-deferred accounts like IRAs. In its simplest form, the minimum distribution is the portfolio value divided by life expectancy. It is designed to ensure that at death there is only a small portfolio balance.

Inflation Haircut. Income is increased by one percentage point less than the rate of inflation. This more closely replicates actual retirees’ spending patterns, which show that retirees do not usually increase annual spending in line with inflation.

The table below compares the methods by examining 5 key factors:-

- The Starting Withdrawal Rate – a higher rate will usually be a retiree`s preference

- The Lifetime Withdrawal Rate – the higher rate indicates that the retiree will receive more income during his life

- 30 Year Cash Flow Standard Deviation – indicates the variability of income

- Median 30-Year Ending Value – shows the potential size of the portfolio after 30 years

The tradeoffs between methods are clear. The higher the total income received the lower the final portfolio value. The highest total income received is also associated with the greatest variation in income which may concern some retirees. The Guardrails strategy offers the highest initial income with a total lifetime income significantly higher than Bengen`s inflation-linked income but at the cost of a variable income level and of course a lower final portfolio value. The higher starting income using Guardrails is a big plus but the risk of an income cut is a big negative. The method is one of the most complex of the common strategies so is one that favors those retirees who use a financial advisor.

The simplest strategy of just forgoing inflation when the portfolio declines is similar to my own Withdrawal Strategy but without the potential bonus upside. It is simple to implement and provides a higher initial income and an uplift in total income received.

The Morningstar study shows that even a simple Dynamic Withdrawal strategy can improve upon Bengen by providing a higher initial income and a greater total income during retirement.

5. A Great Review of the 4% Rule and withdrawal Strategies

There is a truly excellent podcast and YouTube episode from the Rational Reminder that is a compilation of interviews with some of the leading experts on retirement planning focussing on the subject of the 4% Rule and Variable Withdrawal Strategies

Contributors include.-

- Bill Bengen, creator of the 4% rule

- Wade Pfau speaks about how the 4% rule doesn’t work in an international context

- The importance of having flexibility in retirement spending with Moshe Milevsky

- Variable spending rules with Michael Kitces; ratcheting, guardrails, and more.

- FIRE proponent Scott Rieckens on the 4% rule as a guide, not a rule

With the exception of Bill Bengen, there is a fair amount of criticism of the 4% Rule and a dig at the FIRE community with the statistic that the 4% Rule has only ever worked in the USA, Canada, Denmark and Sweden and that it has never worked anywhere for retirements of over 30 years. The interview with Professor Moshe Milevsky is particularly sparky with his scathing views of the idea of a retirement spending strategy that is completely independent of how markets and the portfolio are actually performing.

Some Brief Conclusions

Variable (Dynamic) Drawdown. Michael Kitches, Moshe Milevsky, Morningstar and my own research (Variable Drawdown – A Powerful Strategy to Maximize Drawdown Income) illustrate the benefits of not following Bengen`s constant real drawdown method where income is annually adjusted for inflation. Adopting pretty well any of the Variable (Dynamic) Drawdown strategies provides the retiree with:-

-

-

- A Higher Initial Income

- A Higher Total Income in retirement

- Adjustment of income in accordance with market perfomance

- Protection against sequence of return risk

- The ability to balance retirement income with the final estate value

-

The 4% Rule Wouldn’t it be wonderful if the experts agreed?! However, there is little consensus about just what percentage a retiree can safely withdraw from his retirement portfolio. Retirement researchers take different approaches. Some such as Morningstar try to predict future equity and bond returns and inflation rates. More commonly historic market data is used but some researchers believe this to be both to be inaccurate and too limited in duration to forecast future behaviors. Overall there is little agreement and a wide range of recommended withdrawal rates.

So as retirees we have to devise plans that cater with up having to base our financial plans on SWRs ranging from 2% to over 4% for a 30 year retirement. If we accept this range of potential scenarios then the only sensible plan for a retiree is to adopt a strategy that hopes for the best but is prepared for the worst. This implies not depending 100% on income derived from an investment portfolio but to have a variety of income streams some of which such as state pension, defined benefit private pensions, lifetime annuities and bond ladders provide a guaranteed cash flow and these can then be combined with investment income which although likely to be more unpredictable does provide the potential to benefit from good market potential.

Very helpful in deciding the most efficient way to withdraw money from my small ( £40,000) private pension.

I would like to see some scenarios other than a 30 or 35 year retirement plan as, with a retirement age in the UK of 66

it’s unlikely that the majority of retirees will live for another 30 or 35 years,

A 15 or 20 year plan my be more relevant for those of us not able to take early retirement.

p,s, I am very interested in your MaxVar plan and will probably go that way. Is there any advantage as to the time of year I should begin

to withdraw funds?

I am very pleased you have found the site If of use. 15 to 20 years seems pessimistic unless there are underlying health worries. I think you can simulate shorter drawdown times on portfoliocharts.com -but its no longer free. There are several US based simulators (portfoliovizualiser.com is very good) but they don`t take the greater UK historic inflation into account and there is currency risk but they can be useful in indicating the effect on SWR of shorter retirement periods.

I use vanguard for my drawdown portfolio. It`s not the cheapest option but drawdown can be completely automated and they offer the option of monthly payments where if you hold more than one fund you specify the proportion of each to be sold by them. I prefer this to manually selling and having the dilemma of when to sell – a kind of revere pound cost averaging.