Investment Trusts are Re-vamping Their Portfolios – Will This be Sufficient to Protect Their Payouts?

Can Income Investment Trusts avoid cutting their dividends? Anyone relying on their income from dividends paid by Income Investment Trusts will be worried by the prospect of substantial reductions in dividend payouts.

Over 50% Of Major Companies Are Cancelling or Reducing Dividends

With the pretty much daily reports of some of the historically secure dividend shares cutting or eliminating their dividends (Shell, BT, Imperial Tobacco, HSBC, Lloyds ….) and with over 50% of major companies cancelling or reducing dividends it is inevitable that the ability of Income Investment Trusts to avoid cuts even with their substantial revenue reserves has been questioned.

Income Investment Trusts Are Keeping Quiet – But Are Making Moves

The almost universal silence from the ITs about their plans is not confidence inspiring.

However, the evidence is that the portfolio managers haven´t just been twiddling their thumbs in lockdown. The signs are that they have been gradually adjusting their portfolios to minimise the income hits they are would otherwise receive.

Trust Managers have an Advantage Over the Private Investor

Trust managers have the great advantage over the private investor in that they get to talk to the finance directors and CEOs of the companies in which they are investing and are therefor in a far better position to judge their dividend prospects than the average investor as there are companies who have undoubtedly used Covid-19 as a pretext to rebase their dividend payouts, others than have made short term cuts as a result of political and social pressure and others such as in the hospitality and leisure sectors who are likely to endure long term pain or may not even survive.

Have a Look at The Portfolio Changes

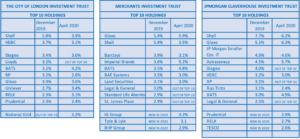

It is interesting to look at the portfolio changes that have occurred within three of the UK´s largest and most popular income ITs, City of London, Merchants and Claverhouse to see how trust managers are responding to the lean dividend environment.

The tables below show their portfolio changes since January of this year:-

The City of London Investment Trust:- City Of London holds the record as the Income Investment Trust with the longest period of annual dividend increases – 53 years. It currently yields 5.5%, its share price has fallen 25% year to date and has reserves to cover dividends for 0.74 years (lower than the majority of its peers). Since December 2019 it has shifted away from banks and oil increasing its weighting traditionally defensive stocks such as tobacco, pharmaceuticals and utilities.

Merchants Investment Trust:- Merchants Investment Trust has raised its dividend for 37 years. It currently yields 7.0%, its share price has fallen 29% year to date and has reserves to cover dividends for 0.99 years. Merchants has made some significant portfolio changes, reducing holdings in finance, insurance and oil, increasing weightings in tobacco and pharmaceutical

JOMorgan Claverhouse Investment Trust:- JPMorgan Claverhouse has raised its dividend for 46 years. It currently yields 5.0%, its share price has fallen 24.5% year to date and has reserves to cover dividends for 1.5 years. Claverhouse like City of London and Merchants has reduced its weighting in oil and financials, upped weightings in tobacco and pharma and like Merchants has reduced its holding in Legal & General despite L&Gs decision to go ahead with its final dividend payment.

Should There be Gloom About Dividend Prospects?

It is easy to be gloomy about Investment Trust dividend prospects with over a third of FTSE 350 companies suspending or cancelling dividends and around 25% of the total FTSE 100 forecast dividend payouts for 2020 being cancelled.

Yes it is clear that ITs have only just started to adjust their portfolios, but will that be sufficient to maintain income?

What Is The Outlook For The Top 15 Dividend Payers?

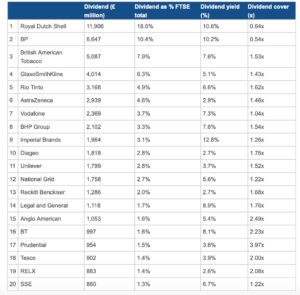

Over 70% of the total dividends paid by FTSE100 companies in 2019 originated from 15 companies.

Shell and Imperial Group have announced a reduction in dividends and National Grid and Unilever have gone ahead with small increases in interim payments. However, BP is almost certain to have to cut unless there is a significant recovery in oil price and Legal & General, unique among UK insurance companies to go ahead with its most recent dividend payment may yet succumb to dividend cut pressure .

|

FTSE 100 Top 20 Dividend Payers in 2019 (moneyobserver.com) |

How Would The Income of An Investor in The Top 15 Payers Be Affected

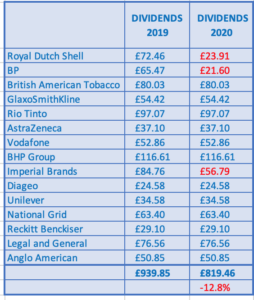

The table blow shows a theoretical investment of £1000 in each of the top 15 dividend payers made in January 2019 and the dividends received in 2019 and the projected dividends for 2020 based upon announced changes and an assumed cut in BP´s dividend of 67%.

|

| DIVIDENDS FOR A £1000 INVESTMENT JANUARY 2019 |

The investor sees a fall in dividend income of 12.8% in 2020 and apart from the risk from Legal & General this level of dividend is likely to be maintained in 2021. What is notable from the top 15 payers is the absence of companies in sectors severely hit by the Covid-19 crisis such as travel, leisure and hospitality, retail and banking.

Move to protect Revenue – But Net Asset Values Will be Hit

It would appear that without much fanfare Income Investment Trusts are reallocating assets in their portfolios to sectors such as pharmaceutical and tobacco which have secure dividends (or have already been cut in the case of Imperial Brands). This move to protect revenue will have a negative effect on their net asset values so if dividends payouts are maintained it will be at the cost of capital.

Dividend Heroes Will Not Want to End Track Record

ITs that have 30 or 40 years of sustained dividends will be very unwilling to break this track record. Whilst it would be difficult to avoid any reduction in dividend revenue over the next 24 months it would seem to be perfectly possible to limit this to less than 20% in 2020 and 2021 and providing the economy recovers strongly in 2021 then 2022 should see a recovery in dividend income. If Income Investment Trusts do not reduce their dividend payouts in 2020-2023 they will have to dig into revenue reserves reducing them by around the equivalent of 6 months cover. This would still leave the strongest amongst them with 6 months or so cover.

Investors Should Be Reassured – Buying Opportunity?

There is probably too much gloom and despondency about the UK Income Investment Trust sector which is evidenced by the sector´s underperformance compared to the FTSE All Share. Maybe those investors who rely on ITs for income will be pleasantly surprised particularly holders of trusts that have a long track record of sustained dividends and healthy reserves. For some investors the poor rating of the sector may be a buying opportunity (I have topped up my holdings in Schroder Income Growth and Murray International) but care is needed as some trusts are stronger than others in terms of revenue reserves and portfolio content.

Been doing a lot of reading on ITs recently in considering a form of "managed dividend growth investing" in the run up to an early retirement… Would be good to get your take on the discounts seen on the UK Equity Income space – particularly considering the management changes going on at present!

Hi Tom – I must apologise as I completely missed your comment back in August. I wish I had a crystal ball! My own IT income portfolio is yielding 5.8% compared to 3.7% from the FTSE100. With forecasts of average yield heading toward 3% ,5.8% must be unsusbstainable and can only be corrected by an increase in IT prices, a cut in dividends or a combination of both. I have assumed a cut in dividends of around 20% which on current valuation would still result in a yield of 4.6%.

There have been limitted comments from the ITs about their dividend intentions except most notably the cut by Temple Bar and the committment from City of London to maintain payout levels. I think that even with substantial dividend cuts many ITs with healthy reserves and track records to maintain will be providing a good level of income.

After the 2008 crash it took 12-18 months for some of the weaker ITs to cut their dividends but the better ones even increased them. OK this crisis is different but there are glimmers of hope with talk of banks pressurising the regulator to allow dividend payments and several companies restoring payouts – some retrospectively. It´s well worthwhile taking a look at how some IT portfolios have quickly been reconstituted to avoid the sectors such as hospitality and travel that may take years to recover. I am still a strong believer that an internationally diversified portfolio of income ITs can deliver an increasing income providing you are not over converned about variations in portfolio value. If capital preservation is a priority then holding government bonds is essential whether it be through a classic 60/40 portfolio or as in my case with a Golden Butterfly style portfolio (I have 2 Golden Butterfly portfolios and 2 IT income portfolios – talk about sitting on the fence!).