Holding a fund with average charges on a platform with average fees can easily eat up 12.5% of a pensioner´s income drawdown. Higher cost platforms can cut drawdown income by 15% or more.

An investment of £100k in funds and with 4 trades per year can cost between £20/year and £450/year in platform fees. With £500k in funds costs vary between £20/year and £1250/year. An annual account fee of 0.25% may not seem that high but for a retiree in drawdown taking out 4% p.a. that equates to 6.25% of his income being eaten up by broker fees – add in another 0.25%+ fund charges then at least 12.5% of his income is taken in fees.

Going For a Low Cost Platform and Low Cost Index Funds Cuts Fees by 75%

Investing in low cost low cost tracker funds (OCF <0.1%) and holding them in a low cost platform such as Halifax´s Iweb which has no annual account fee can reduce total fees for a £100k investment and 4 trades/year to £120/year (including the fund OCF) . For a pensioner drawing down at 4% fees are cut to 3% of the annual drawdown income.

Changing Platform Can be the Easiest Way to Boost Income

The Most Expensive Platform Will take over 10% of Your Drawdown Income

– The Cheapest 0.5%

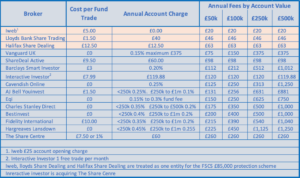

The table below compares charges based on 4 trades per year and account holdings between £50k and £500k held in an ISA or share share dealing account. Fees vary from £20/year with Halifax´s Iweb to £1250/year with Cavendish and Hargreaves Lansdown for clients with £500k in investments.

Why Pay More?

In general the higher the fees charged the more comprehensive the market research provided. However, all of this information is available free on the internet so there is no justification in paying higher fees for the convenience of having this information integrated within the account. The higher cost brokers usually offer more sophisticated web sites and apps and often have portfolio analysis tools, easy exporting and reporting all integrated within their sites – but there is a high price to be paid for these functions and many investors don´t need this level of functionality.

Which Funds, Shares and Bonds Can be Traded?

What About Vanguard?

It is only fairly recently that Vanguard has offered ISA, SIPP and trading accounts and now undercuts most of the major players such as Hargreaves Landsdown and AJ Bell with an annual account fee of 0.15% capped at £375. Most investors will find the range of funds and ETFs offered adequate even though it is limited to its own branded products. It is a shame that UK investors have to pay far more than their US cousins – LifeStrategy funds there have fees of around 0.13% compared with 0.22% in the UK and subject to a few restrictions there are no annual management fees.

An account at Vanguard is not the cheapest way to hold Vanguard funds but the company as one of the world´s largest offers security and great convenience for an investor in drawdown as one can choose a monthly, quarterly or annual cash withdrawal and Vanguard will automatically sell sufficient units to cover the payment.

Purchasing Direct From The Fund Manager

Most fund manager offer ISAs and general accounts so investors may purchase direct from them. Some such as Fundsmith allow regular cash withdrawals to be programmed and they will redeem units to cover the payments. Most have no trading or annual account fees, allow easy switching between funds and offer regular savings schemes. However their systems tend to be clunky and paper driven and lack the ease of online platforms.

If You Change Your Mind How Easy is it to Transfer Out?

How Safe Will My Investments Be?

£85,000 is Inadequate Protection for many Retiree´s Life Savings

One Day Disaster Will Hit

How Do I Minimise Risk to my Investments?

- Use substantial reputable brokers

- Spread Investments between brokers in ISA and share trading accounts

- Hold some investments direct with the provider – for instance Fundsmith direct rather than through a platform

- If a SIPP is not in drawdown it can be split between brokers

- Pension Annuities are 100% guaranteed by the government so consider using part of a SIPP in drawdown to purchase one