Bonds are incorporated into portfolios to stabilize against falls in the stock market. They are considered as an asset class that acts independently from stocks so reducing the volatility that an all-stock portfolio would exhibit. However ……

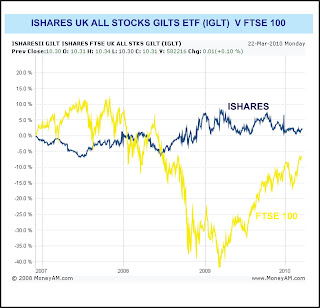

The above graph of the performance of the ISHARES ETF Sterling Corporate Bond Fund (SLXX) against the FTSE100 clearly shows both the contrarian response of the corporate bond market at the start of the market crisis in 2007 where there is a 10% fall in the FTSE but a 10% rise in the ISHARE Corporate Bond ETF. However, as the crisis deepens the bond ETF falls nearly 40% compared to a 35% fall in the FTSE 100 – so much for the safety of bonds!

The above graph of the performance of the ISHARES ETF Sterling Corporate Bond Fund (SLXX) against the FTSE100 clearly shows both the contrarian response of the corporate bond market at the start of the market crisis in 2007 where there is a 10% fall in the FTSE but a 10% rise in the ISHARE Corporate Bond ETF. However, as the crisis deepens the bond ETF falls nearly 40% compared to a 35% fall in the FTSE 100 – so much for the safety of bonds!