The table below from an article by Jeff Merriman-Cohen illustrates clearly the effect on volatility and growth of portfolios containing various S&P 500 and 5 Year T-Notes from 1970 to 2008. The average annualised return of an all bond portfolio was 8.5% compared to 9.5% from a 100% equity portfolio. However, the worst performance over 12 months of the 100% equity portfolio was -38.9% compared to -5.5% from 100% bonds.

a 50/50 equity bond splits results in an average return of 9.2% and a worst 12-month performance of -20.6%. The trade-off between stability and performance is clear – if you want the ultimate returns over the long term you must be prepared to accept high volatility with large peaks and troughs in the portfolio’s capital value.

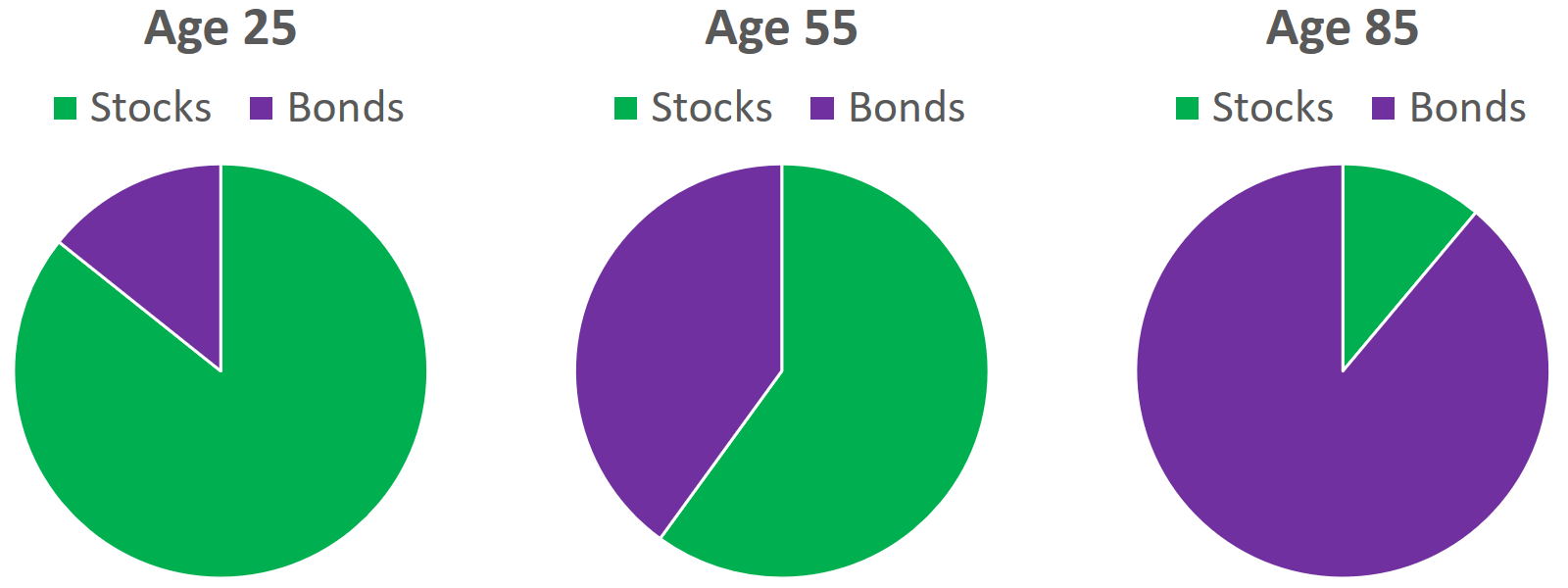

The accepted practice has always been to advise investors to increase their bond weightings in their portfolios as they get older. Younger investors are often recommended to have a 100% stock portfolio as it is assumed they will not need access to their capital for 20+ years sufficient time to recover from market dips. A popular rule of thumb is that the equity portion of a portfolio should be 100 – (the investor’s age) i.e. a 60-year-old should have 40% in stocks and an 80-year-old 20% etc.

This makes the enormous assumption that there is a direct relationship between an individual’s risk profile (or need to access his capital) and his age. This is a dangerous generalisation. Someone in their 30’s may need access to capital to pay for education, cover redundancy, or pay for a health emergency. A retiree may well have an inflation-proofed government or company pension, excellent health provision, and the aim to pass on his investments intact to his kids or grandkids.

The amount of volatility or risk that one can accept will vary throughout one’s life and the awareness of this is a crucial factor in implementing one’s investment strategy.