Deferred Pension Annuities are common products in some markets such as the USA where you purchase an annuity either with a lump sum or scheduled payments and defer accessing the income until a later date. They are not so well known in the UK and certainly up to a couple of years back they weren’t commonly available. In fact, many retirees do defer taking an annuity by firstly entering drawdown and later on annuitising – essentially creating a DIY Deferred Annuity.

Analysis shows that for most retirees deferring taking an annuity is probably not the best financial decision as the total income received is likely to be lower by deferring (certainly during the first 20 years or so of retirement) rather than immediately purchasing an annuity on retirement. However, other non-financial factors often influence a decision.

What is A Deferred Annuity

It is a type of annuity that is designed to start paying out at a future date, usually after a specific period of time or when the annuitant reaches a certain age.

Here’s how it works: When you purchase a deferred pension annuity, you make a lump sum payment or a series of payments to the annuity provider. The provider then invests these funds and allows them to grow over the deferral period. During this time, the annuity accumulates value and earns interest. The rate of interest is usually set on an annual basis during the deferment phase of the the annuity and is often subject to a minimum level.

Once the deferral period ends or the annuitant reaches the predetermined age, the annuity starts making regular payments to the annuitant. These payments can be structured to provide a fixed amount or be adjusted for inflation, depending on the terms of the annuity contract. The payments continue for the rest of the annuitant’s life or for a specific period, depending on the type of annuity chosen.

Advantages

One of the main advantages of a deferred pension annuity is that it allows individuals to accumulate funds for retirement while deferring the receipt of income until a later date. This can be beneficial for individuals who want to plan for future retirement income and have the ability to save and invest funds over time.

It’s important to note that the specific terms and conditions of a deferred pension annuity can vary depending on the annuity provider and the annuity contract. There are several advantages to taking a deferred annuity rather than an immediate annuity. Here are some key benefits:

- Retirement Planning: A deferred annuity allows you to plan for retirement by accumulating funds over a specific period. This gives you the opportunity to save and invest money while you are still working and potentially benefit from compounding growth. It can be a useful tool if you have a longer time horizon before you need the income.

- Potentially Higher Payouts: Since the funds in a deferred annuity have more time to grow, the potential for higher payouts in the future is greater compared to an immediate annuity. The growth can be influenced by factors such as investment performance and interest rates. By deferring the start of payments, you may have a larger pool of funds available to generate income in the future.

- Tax Deferral: In many cases, the growth of funds in a deferred annuity is tax-deferred. This means that you do not have to pay taxes on the earnings until you start receiving payments. This can be advantageous as it allows your investment to potentially grow faster, as taxes are not eroding the growth each year.

- Flexibility: With a deferred annuity, you have flexibility in determining when you want to start receiving income payments. This can be beneficial if you have other sources of retirement income or if you want to delay payments until you reach a certain age or retire.

- Estate Planning: If leaving a legacy or passing on assets to beneficiaries is important to you, a deferred annuity can be advantageous. If you pass away before receiving payments, the remaining value of the annuity can be passed on to your designated beneficiaries, potentially providing them with a financial benefit.

Disadvantages of Deferring An Annuity

A deferred annuity is not for everyone and in most situations, a conventional Immediate Annuity might be far more appropriate. Here are some of the specific disadvantages of a deferred pension annuity when compared to an immediate annuity:

- Delayed Income: The primary disadvantage of a deferred pension annuity is that it delays the start of your income payments until a future date. With a deferred annuity, you typically need to wait until you reach a certain age or a specified period before you can start receiving payments. This means you won’t have immediate access to income from the annuity, which can be a drawback if you need the funds for living expenses right away.

- Uncertainty: Since the income payments from a deferred pension annuity are determined based on future factors like interest rates and investment performance, there can be a level of uncertainty regarding the exact amount you’ll receive when the annuity starts paying out. This uncertainty can make financial planning more challenging, as you won’t have a clear picture of your retirement income until the payments begin.

- Inflation Risk: By deferring your annuity payments, you expose yourself to the risk of inflation eroding the purchasing power of your future income. Over time, the cost of living tends to rise, and if the annuity payments do not increase to keep up with inflation, you may find it more difficult to maintain your desired standard of living.

- Opportunity Cost: By choosing a deferred annuity, you essentially lock up your funds for a specific period without the ability to access them. This lack of liquidity can be a disadvantage if you encounter unexpected expenses or require access to your savings for other investment opportunities. It’s important to carefully consider the trade-off between a deferred annuity’s long-term benefits and the potential need for immediate access to your funds.

- Interest Rate Risk: The value of a deferred annuity is sensitive to interest rates. If interest rates decrease significantly between the time you purchase the annuity and when it starts paying out, it could impact the amount of income you receive. Lower interest rates may result in lower annuity payments, which could be a disadvantage if you were counting on a specific income level.

- Changes in Personal Circumstances: Since the payments from a deferred pension annuity begin at a future date, there is a possibility that your personal circumstances may change during the deferral period. Life events such as unexpected health issues, financial hardships, or changes in family situations could make the delayed income less beneficial or potentially not aligned with your evolving needs.

Whilst deferred annuities are well established in the US there is limited availability from Life Insurers in the UK. So whilst it is easy to compare and assess Lifetime Annuities this is not the case with Deferred Annuities.

Take The Money Now or Defer?

Waiting until age 75+ to purchase an annuity has the advantage of being able to obtain a higher income than at age 65 – simply because of the reduced life expectancy. This can be seen from the table below from Sharing Pensions which shows current annuity rates. A single-life annuity at age 75 gives £9484 income for £100k purchase, nearly 30% more than at age 65.

Say a retiree doesn’t need the maximum initial retirement income but he prefers the certainty that an annuity provides compared with the volatility of being invested in stocks and bonds. Is he better off purchasing a Lifetime Annuity immediately, at age 65 or deferring the purchase until say age 75 when annuity payout rates could be higher due to the higher “longevity credits” and the growth of the initial lump sum. Its impossible to answer this definitely as no-one can predict annuity rates in 10 years time not the effect of inflation. But I will look at what is probably an optimistic (in favor of deferment) below:-

-

-

- Assume a single 65 year old who will either purchase a fixed Lifetime Annuity with £100k or invest it in a 10-year gilt and then at age 75 purchase a Lifetime Annuity.

- Average rate of inflation over 10 years: 4%

- Yield to maturity on 10 year gilt: 4.5%

- Annuity rate per £100k at age 65 £7352 and at age 75 £9484

- At age 75 the fund invested at 4.5% will grow to £155,297

-

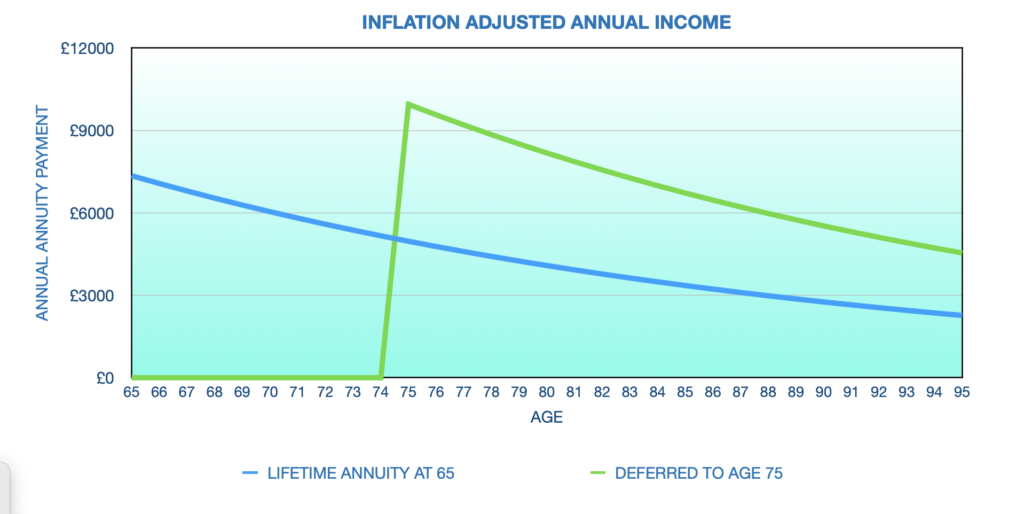

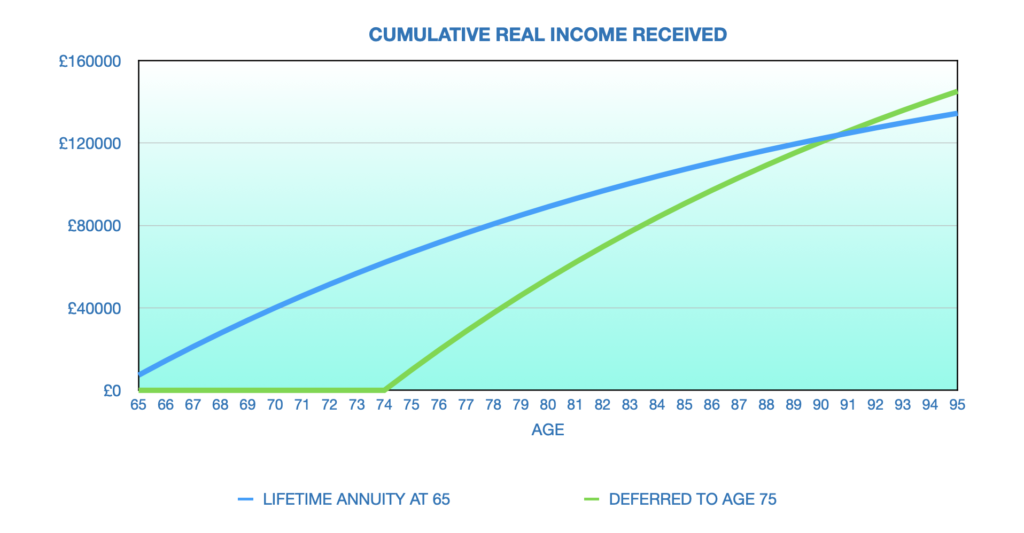

In the graphs below all income has been adjusted to show “real” inflation adjusted income assuming a 4% inflation rate. The deferred annuity kicks in at age 75 and produces almost double the real income of the immediate annuity taken at age 65. However, in the second graph which shows the total cumulative real income received it takes until age 91 for the deferred annuity to produce more total income. Certainly most retiree would welcome a higher income in the earlier part of retirement and this also reflects the typical spending characteristics of retirees. So most retirees would be far better off not waiting to annuitise. This is the current situation but a few years back with super-low annuity rates retirees would have been well rewarded by waiting.

Conclusion – It is Difficult to Justify Deferment on Purely Financial Grounds

The above analysis can only be an approximate analysis because no-one can predict annuity rates in 10 years time nor future inflation rates. What is very clear is that for most retirees with current annuity rates it is far better financially to purchase an immediate annuity at age 65. There are however, some factors which could influence any decision:-

- Taxation: If longer term an individual`s income tax rate is likely to reduce then keeping capital in a tax sheltered wrapper such as a SIPP until the retiree has a lower marginal tax rate could be worthwhile.

- Inheritance Tax: Pensions are exempt from inheritance tax so if additional income is not needed and maximizing bequests is a priority then it would be best not to withdraw the funds.

- Flexibility: Health and other personal issues might favor taking a lump sum from a pension fund at a later date (even if it will be subject to tax).

- The potential for greater fund growth through equity investing. The analysis above assumes safe investing in gilts. An investor who has no need for additional income and is not risk averse could invest wholly or partly in equities during the deferment period and potentially achieve a higher fund growth rate and therefor a far larger annuity income at the end of the deferment period.

- The Annuity Conundrum – financial researchers don’t understand the reluctance of retirees to purchase annuities but human nature is such that there often exists a psychological barrier to annuity purchase.