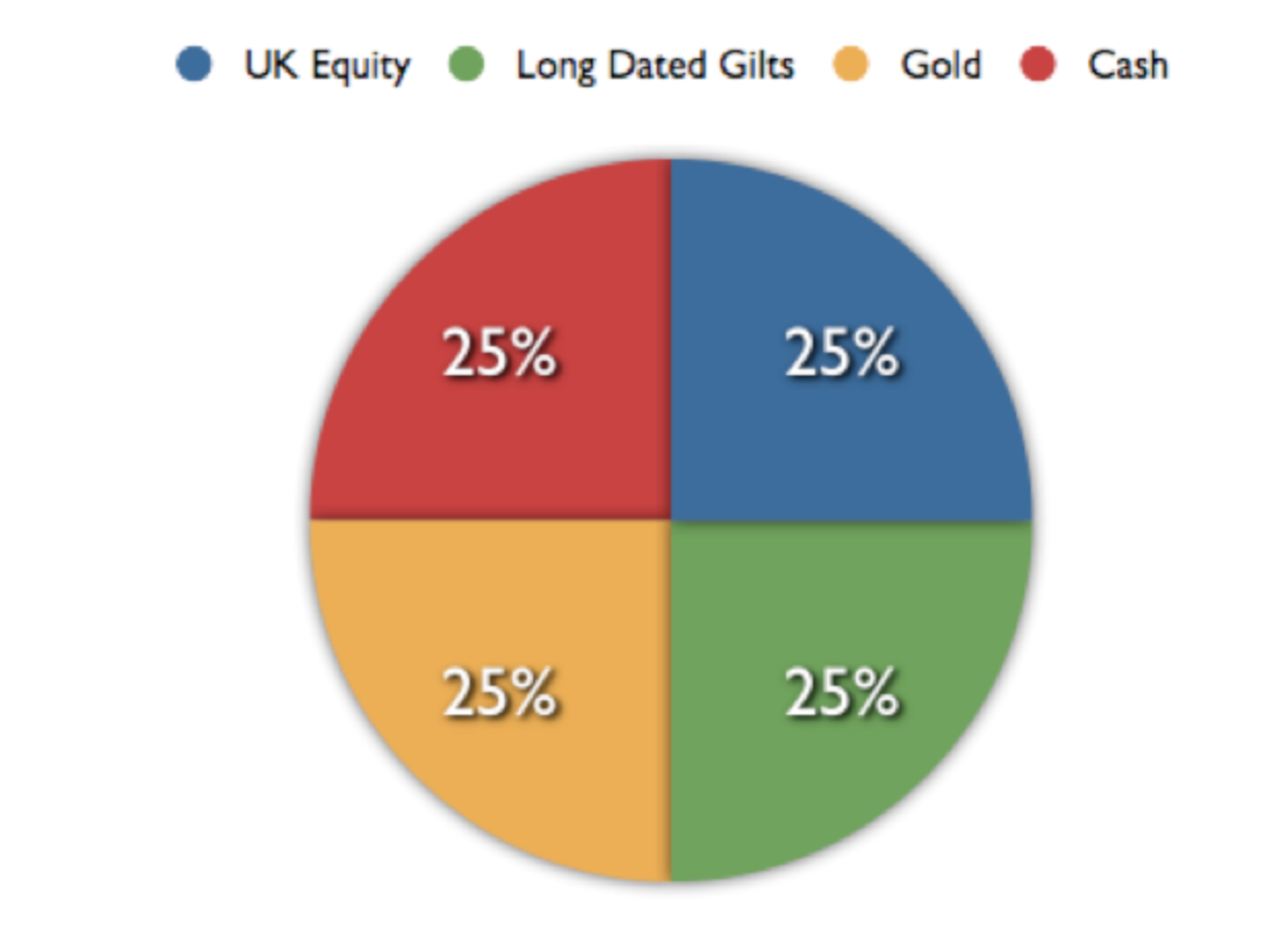

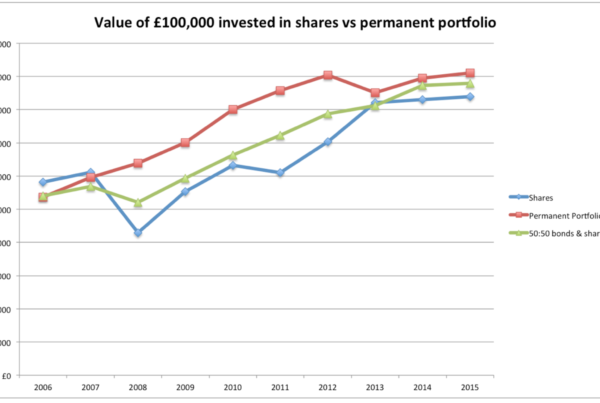

I´m sure most people interested in finance have come across Harry Browne´s Permanent Portfolio as it is much discussed on finance forums. The concept is simple – 4 uncorrelated asset classes that protect the portfolio in all market conditions. Long date government bonds to protect against deflation, gold to protect against inflation and currency devaluation, the stock market to provide long-term growth, and cash as the ultimate safety net.

Much discussed and also much criticised, particularly the presence of gold which commentators say provides no income and often has no price growth during many years. However, gold did rise in price considerably after the stock market crashes of 73-74, 2000 and 2008 so has shown its ability to provide a portfolio with some protection during market turbulence.

“Fail-Safe Investing: Lifelong Financial Security in 30 Minutes”

by Harry Browne

A Portfolio For Retirees

|

| Permanent Portfolio – 11% Max Fall In Value Maximum of 4 Years To Recover |

|

| Permanent Portfolio – 5.5% Safe Withdrawal Rate, 4% Perpetual |